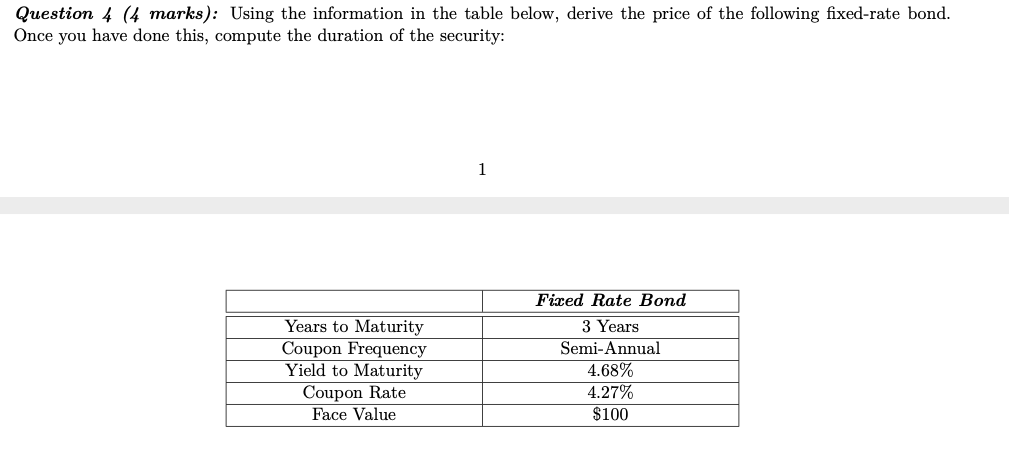

Question: Question 4 (J Hmrks): Using the information in the table below, derive the price of the following xed-rate bond. Once you have done this, compute

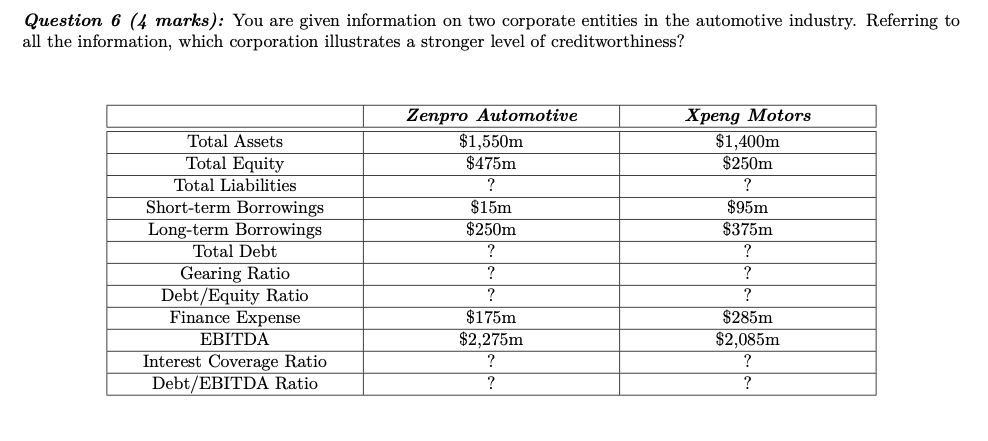

Question 4 (J Hmrks): Using the information in the table below, derive the price of the following xed-rate bond. Once you have done this, compute the duration of the security: I Fixed Rate Band I Years to Maturity 3 Years Coupon Frequency Semi-Annual Yield to Maturity 4.68% Coupon Rate 4.27% Face Value $100 Question 6 (4 marks): You are given information on two corporate entities in the automotive industry. Referring to all the information, which corporation illustrates a stronger level of creditworthiness? Zenpro Automotive Xpeng Motors Total Assets $1,550m $1,400m Total Equity $475m $250m Total Liabilities ? ? Short-term Borrowings $15m $95m Long-term Borrowings $250m $375m Total Debt ? Gearing Ratio Debt/Equity Ratio .-9 Finance Expense $175m $285m EBITDA $2,275m $2,085m Interest Coverage Ratio Debt/EBITDA Ratio --9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts