Question: Question 4 of 4 View Policies Current Attempt in Progress < In 2022, Metlock Corp. sold equipment that cost $59,000 and had accumulated depreciation

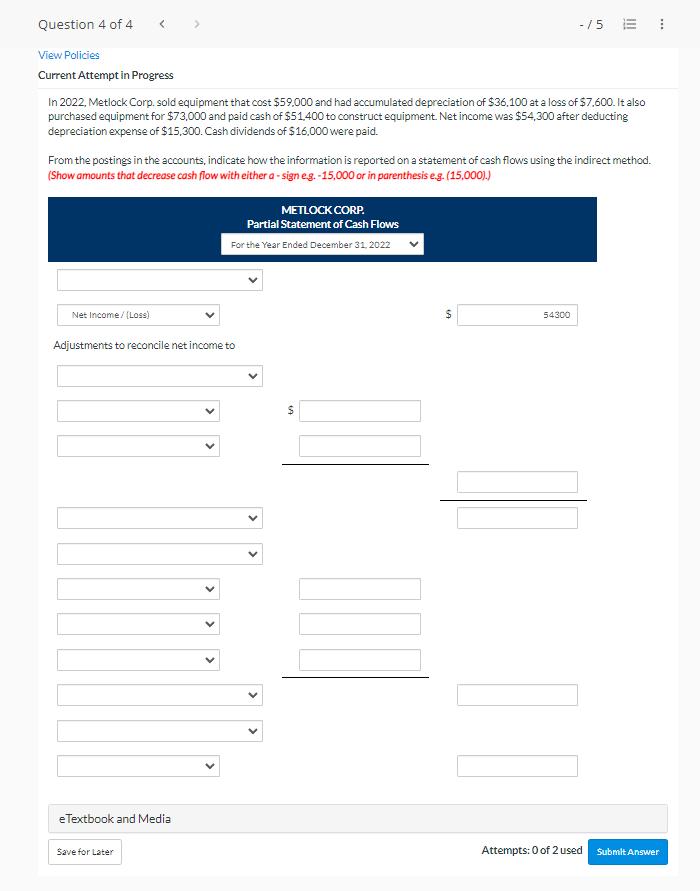

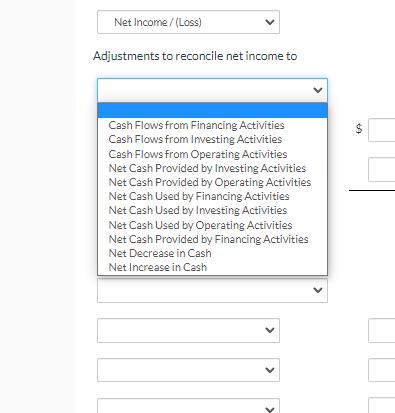

Question 4 of 4 View Policies Current Attempt in Progress < In 2022, Metlock Corp. sold equipment that cost $59,000 and had accumulated depreciation of $36,100 at a loss of $7,600. It also purchased equipment for $73,000 and paid cash of $51.400 to construct equipment. Net income was $54,300 after deducting depreciation expense of $15,300. Cash dividends of $16,000 were paid. Net Income/(Loss) From the postings in the accounts, indicate how the information is reported on a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a-sign e.g. -15,000 or in parenthesis e.g. (15,000).) Adjustments to reconcile net income to eTextbook and Media Save for Later < < METLOCK CORP. Partial Statement of Cash Flows For the Year Ended December 31, 2022 > > > to -/5 = 1 54300 [] Attempts: 0 of 2 used Submit Answer Net Income /(Loss) Adjustments to reconcile net income to Cash Flows from Financing Activities Cash Flows from Investing Activities Cash Flows from Operating Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash Used by Financing Activities Net Cash Used by Investing Activities Net Cash Used by Operating Activities Net Cash Provided by Financing Activities Net Decrease in Cash Net Increase in Cash $

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

METLOCK CORP Partial Statement of Cash Flows For the Year Ended December 31 2022 Cash flow from ... View full answer

Get step-by-step solutions from verified subject matter experts