Question: Question 4: Option Valuation - Black-Scholes (10 marks) Consider a non-dividend paying stock whose current price is $60. You are asked to construct a long

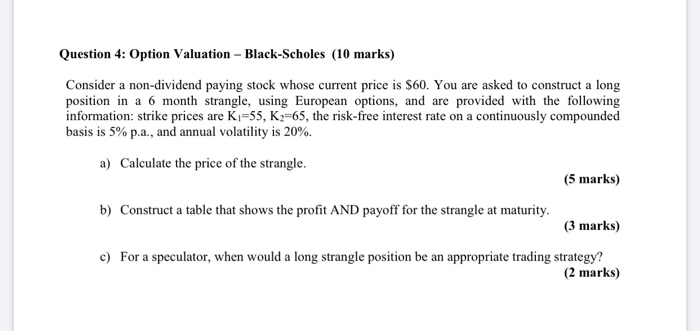

Question 4: Option Valuation - Black-Scholes (10 marks) Consider a non-dividend paying stock whose current price is $60. You are asked to construct a long position in a 6 month strangle, using European options, and are provided with the following information: strike prices are K1=55, K2=65, the risk-free interest rate on a continuously compounded basis is 5% p.a., and annual volatility is 20%. a) Calculate the price of the strangle. (5 marks) b) Construct a table that shows the profit AND payoff for the strangle at maturity. (3 marks) c) For a speculator, when would a long strangle position be an appropriate trading strategy? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts