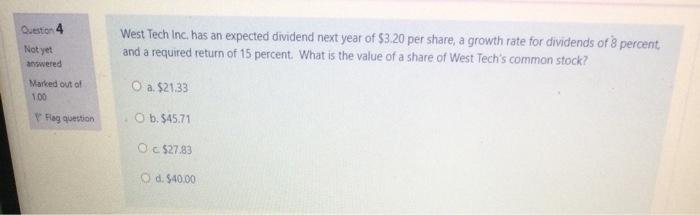

Question: Question 4 West Tech Inc. has an expected dividend next year of $3.20 per share, a growth rate for dividends of 8 percent and a

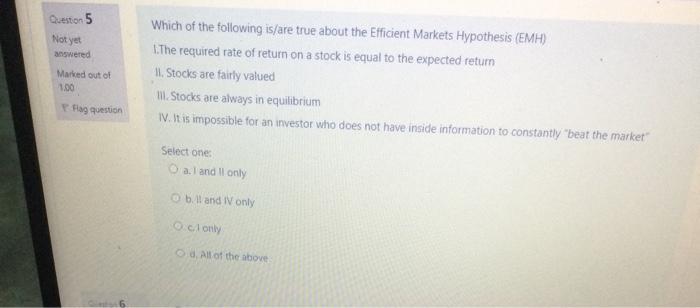

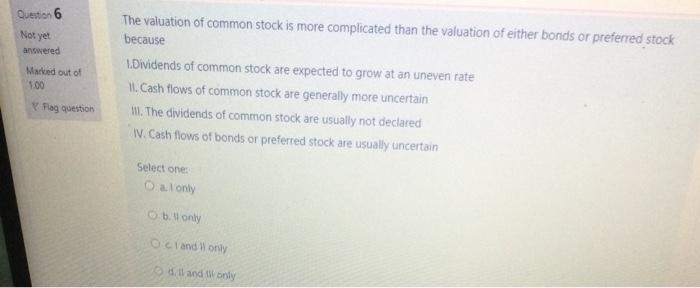

Question 4 West Tech Inc. has an expected dividend next year of $3.20 per share, a growth rate for dividends of 8 percent and a required return of 15 percent. What is the value of a share of West Tech's common stock? Not yet wered Marked out of 100 a. $2133 Fag question O b. $45.71 O c $27.83 d. 540.00 Question 5 Not yet answered Marked out of 100 Which of the following is/are true about the Efficient Markets Hypothesis (EMH) 1.The required rate of return on a stock is equal to the expected retum 11. Stocks are fairly valued II. Stocks are always in equilibrium IV. It is impossible for an investor who does not have inside information to constantly beat the market" Flag question Select one: al and ll only bill and I only O clony All of the above Question 6 Not yet answered Marted out of 1.00 The valuation of common stock is more complicated than the valuation of either bonds or preferred stock because 1. Dividends of common stock are expected to grow at an uneven rate II. Cash flows of common stock are generally more uncertain 1. The dividends of common stock are usually not declared W. Cash flows of bonds or preferred stock are usually uncertain Pag question Select one: O al only b. only O cand only and Wooly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts