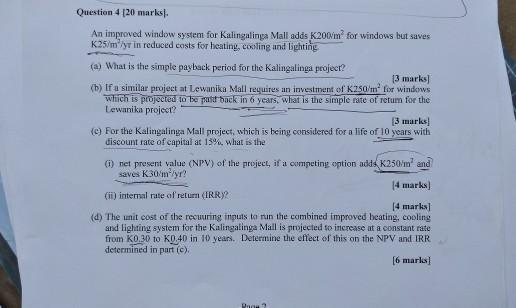

Question: Question 420 marks. An improved window system for Kalingalinga Mall adds K200/m for windows but saves K25/m'y in reduced costs for heating, cooling and lighting

Question 420 marks. An improved window system for Kalingalinga Mall adds K200/m for windows but saves K25/m'y in reduced costs for heating, cooling and lighting (a) What is the simple payback period for the Kalingalinga project? 13 marks] (b) If a similar project at Lewanika Mall requires an investment of K250m for windows which is projected to be at back in 6 years, what is the simple rate of retum for the Lewanika project? 3 marks] For the Kalingalinga Mall project, which is being considered for a life of 10 years with discount rate of capital at 13%, what is the net present value (NPV) of the project, if a competing option adds K250/m2 and saves K30/ myr? (4 marks] (it) internal rate of return (IRRY? [4 marks] (d) The unit cost of the recuuring inputs to run the combined improved heating, cooling and lighting system for the Kalingalinga Mall is projected to increase at a constant rate from KO.30 to KO.40 in 10 years. Determine the effect of this on the NPV and IRR determined in partie). [6 marl] Question 420 marks. An improved window system for Kalingalinga Mall adds K200/m for windows but saves K25/m'y in reduced costs for heating, cooling and lighting (a) What is the simple payback period for the Kalingalinga project? 13 marks] (b) If a similar project at Lewanika Mall requires an investment of K250m for windows which is projected to be at back in 6 years, what is the simple rate of retum for the Lewanika project? 3 marks] For the Kalingalinga Mall project, which is being considered for a life of 10 years with discount rate of capital at 13%, what is the net present value (NPV) of the project, if a competing option adds K250/m2 and saves K30/ myr? (4 marks] (it) internal rate of return (IRRY? [4 marks] (d) The unit cost of the recuuring inputs to run the combined improved heating, cooling and lighting system for the Kalingalinga Mall is projected to increase at a constant rate from KO.30 to KO.40 in 10 years. Determine the effect of this on the NPV and IRR determined in partie). [6 marl]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts