Question: Question 5 1 points Save Answer A 10-year maturity annual coupon-ed bond with a face value of $1,000 and coupon rate of 10% was issued

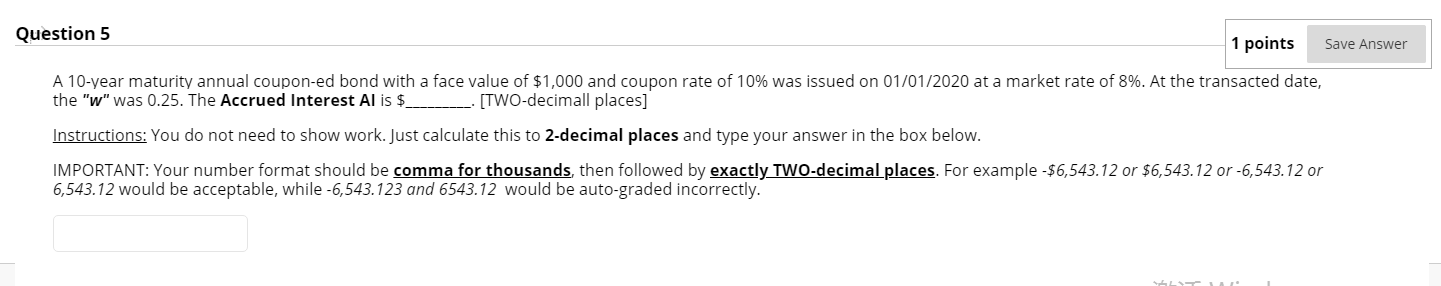

Question 5 1 points Save Answer A 10-year maturity annual coupon-ed bond with a face value of $1,000 and coupon rate of 10% was issued on 01/01/2020 at a market rate of 8%. At the transacted date, the "w" was 0.25. The Accrued Interest Al is $ [TWO-decimall places] Instructions: You do not need to show work. Just calculate this to 2-decimal places and type your answer in the box below. IMPORTANT: Your number format should be comma for thousands, then followed by exactly TWO-decimal places. For example - $6,543.12 or $6,543.12 or -6,543.12 or 6,543.12 would be acceptable, while -6,543.123 and 6543.12 would be auto-graded incorrectly. Question 5 1 points Save Answer A 10-year maturity annual coupon-ed bond with a face value of $1,000 and coupon rate of 10% was issued on 01/01/2020 at a market rate of 8%. At the transacted date, the "w" was 0.25. The Accrued Interest Al is $ [TWO-decimall places] Instructions: You do not need to show work. Just calculate this to 2-decimal places and type your answer in the box below. IMPORTANT: Your number format should be comma for thousands, then followed by exactly TWO-decimal places. For example - $6,543.12 or $6,543.12 or -6,543.12 or 6,543.12 would be acceptable, while -6,543.123 and 6543.12 would be auto-graded incorrectly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts