Question: Question 5 (10 Points) (a) ABC Inc bonds have 25 years remaining to maturity. Interest is paid semi-annually, they have a $1,000 par value, the

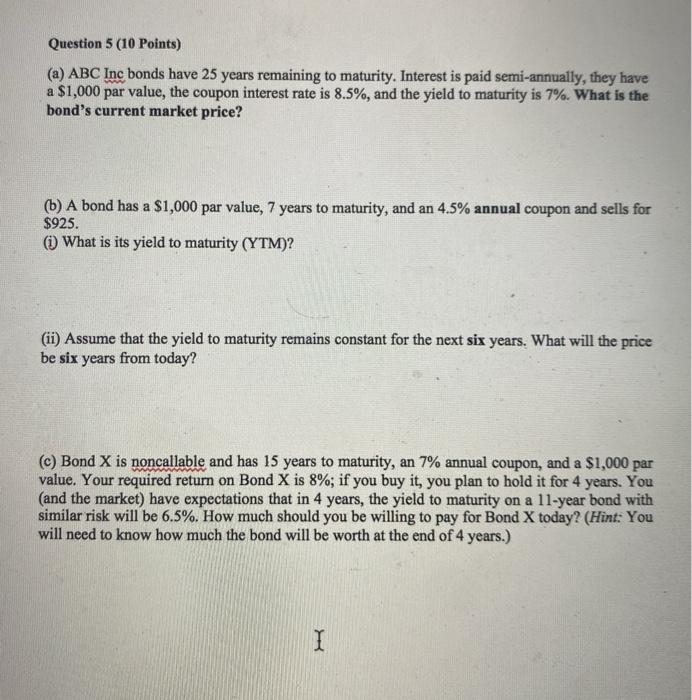

Question 5 (10 Points) (a) ABC Inc bonds have 25 years remaining to maturity. Interest is paid semi-annually, they have a $1,000 par value, the coupon interest rate is 8.5%, and the yield to maturity is 7%. What is the bond's current market price? (b) A bond has a $1,000 par value, 7 years to maturity, and an 4.5% annual coupon and sells for $925. (1) What is its yield to maturity (YTM)? (ii) Assume that the yield to maturity remains constant for the next six years. What will the price be six years from today? (c) Bond X is noncallable and has 15 years to maturity, an 7% annual coupon, and a $1,000 par value. Your required return on Bond X is 8%; if you buy it, you plan to hold it for 4 years. You (and the market) have expectations that in 4 years, the yield to maturity on a 11-year bond with similar risk will be 6.5%. How much should you be willing to pay for Bond X today? (Hint: You will need to know how much the bond will be worth at the end of 4 years.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts