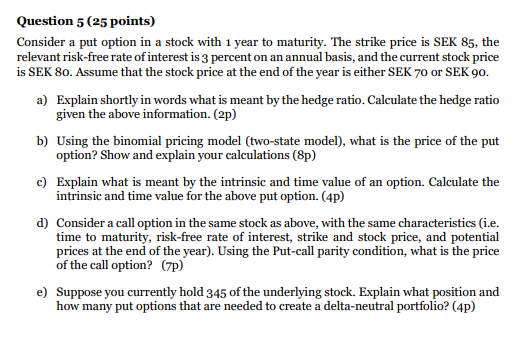

Question: Question 5 ( 2 5 points ) Consider a put option in a stock with 1 year to maturity. The strike price is SEK 8

Question points

Consider a put option in a stock with year to maturity. The strike price is SEK the

relevant riskfree rate of interest is percent on an annual basis, and the current stock price

is SEK Assume that the stock price at the end of the year is either SEK or SEK

a Explain shortly in words what is meant by the hedge ratio. Calculate the hedge ratio

given the above information. p

b Using the binomial pricing model twostate model what is the price of the put

option? Show and explain your calculations p

c Explain what is meant by the intrinsic and time value of an option. Calculate the

intrinsic and time value for the above put option. p

d Consider a call option in the same stock as above, with the same characteristics ie

time to maturity, riskfree rate of interest, strike and stock price, and potential

prices at the end of the year Using the Putcall parity condition, what is the price

of the call option? p

e Suppose you currently hold of the underlying stock. Explain what position and

how many put options that are needed to create a deltaneutral portfolio? p

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock