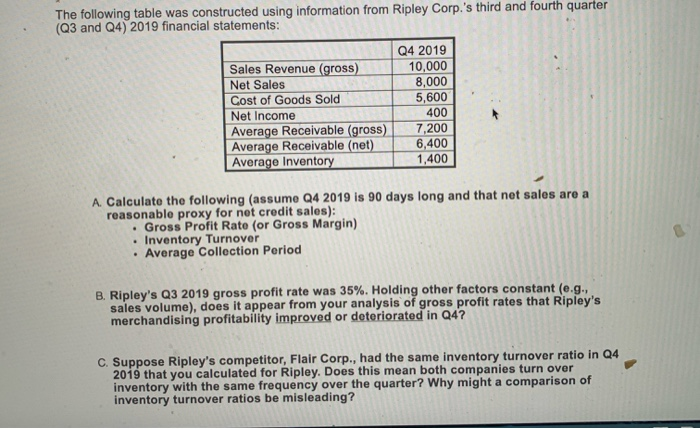

Question: The following table was constructed using information from Ripley Corp.'s third and fourth quarter (Q3 and Q4) 2019 financial statements: Sales Revenue (gross) Net Sales

The following table was constructed using information from Ripley Corp.'s third and fourth quarter (Q3 and Q4) 2019 financial statements: Sales Revenue (gross) Net Sales Cost of Goods Sold Net Income Average Receivable (gross) Average Receivable (net) Average Inventory Q4 2019 10,000 8,000 5,600 400 7,200 6,400 1,400 A. Calculate the following (assume Q4 2019 is 90 days long and that net sales are reasonable proxy for not credit sales): Gross Profit Rate (or Gross Margin) Inventory Turnover Average Collection Period B. Ripley's Q3 2019 gross profit rate was 35%. Holding other factors constant (e.g.. sales volume), does it appear from your analysis of gross profit rates that Ripley's merchandising profitability improved or deteriorated in Q4? C. Suppose Ripley's competitor, Flair Corp., had the same inventory turnover ratio in Q4 2019 that you calculated for Ripley. Does this mean both companies turn over inventory with the same frequency over the quarter? Why might a comparison of inventory turnover ratios be misleading? C. Suppose Ripley's competitor, Flair Corp., nad the same memory 2019 that you calculated for Ripley. Does this mean both companies turn over Inventory with the same frequency over the quarter? Why might a comparison of inventory turnover ratios be misleading? D. Suppose Ripley plans to implement stricter credit policies in Q1 2020. Is this likely to increase or decrease Ripley's average collection period? Explain. E. At the end of Q4, Ripley's accountant noticed that the cash balance on Ripley's 12- 31-19 bank statement disagreed with the cash balance listed in Ripley's trial balanco. If this discrepancy cannot be explained by accounting errors (by Ripley or by Ripley's bank), is it reasonable to conclude that fraud occurred? Explain. The following table was constructed using information from Ripley Corp.'s third and fourth quarter (Q3 and Q4) 2019 financial statements: Sales Revenue (gross) Net Sales Cost of Goods Sold Net Income Average Receivable (gross) Average Receivable (net) Average Inventory Q4 2019 10,000 8,000 5,600 400 7,200 6,400 1,400 A. Calculate the following (assume Q4 2019 is 90 days long and that net sales are reasonable proxy for not credit sales): Gross Profit Rate (or Gross Margin) Inventory Turnover Average Collection Period B. Ripley's Q3 2019 gross profit rate was 35%. Holding other factors constant (e.g.. sales volume), does it appear from your analysis of gross profit rates that Ripley's merchandising profitability improved or deteriorated in Q4? C. Suppose Ripley's competitor, Flair Corp., had the same inventory turnover ratio in Q4 2019 that you calculated for Ripley. Does this mean both companies turn over inventory with the same frequency over the quarter? Why might a comparison of inventory turnover ratios be misleading? C. Suppose Ripley's competitor, Flair Corp., nad the same memory 2019 that you calculated for Ripley. Does this mean both companies turn over Inventory with the same frequency over the quarter? Why might a comparison of inventory turnover ratios be misleading? D. Suppose Ripley plans to implement stricter credit policies in Q1 2020. Is this likely to increase or decrease Ripley's average collection period? Explain. E. At the end of Q4, Ripley's accountant noticed that the cash balance on Ripley's 12- 31-19 bank statement disagreed with the cash balance listed in Ripley's trial balanco. If this discrepancy cannot be explained by accounting errors (by Ripley or by Ripley's bank), is it reasonable to conclude that fraud occurred? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts