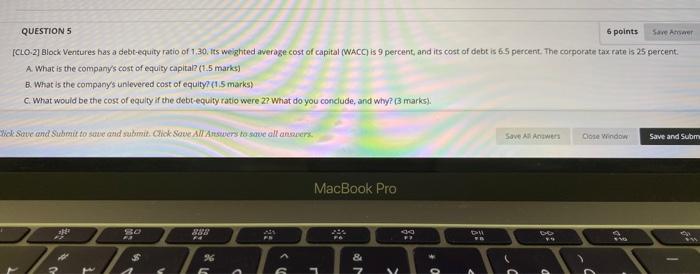

Question: QUESTION 5 6 points Save Aswer ICLO-2) Block Ventures has a debt-equity ratio of 1.30. Its weighted average cost of capital (WACC) is 9 percent,

QUESTION 5 6 points Save Aswer ICLO-2) Block Ventures has a debt-equity ratio of 1.30. Its weighted average cost of capital (WACC) is 9 percent, and its cost of debt is 65 percent. The corporate tax rate is 25 percent. A. What is the company's cost of equity capital? (1.5 marks) B. What is the companys unlevered cost of equity? (15 marks) c. What would be the cost of equity if the debt-equity ratio were 2? What do you conclude, and why? 3 marks) Nick Save and Submit to serve and submit Clok Save All Answers to save all ansavers Save As Answers Ce Window Save and subm MacBook Pro 888 90 946 i 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts