Question: MULTIPLE CHOICE QUESTIONS (10 MARKS) There are five (5) multiple choice questions, each worth two marks. Choose the best answer out of the four options

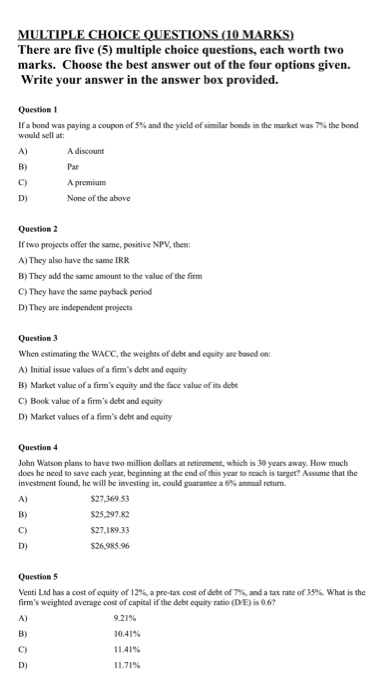

MULTIPLE CHOICE QUESTIONS (10 MARKS) There are five (5) multiple choice questions, each worth two marks. Choose the best answer out of the four options given. Write your answer in the answer box provided. Question 1 If a bond was paying a coupon of 5% and the yield of similar bonds in the market was the bond would sell at: A) A discount B) Par C) A premium D) None of the above Question 2 If two projects offer the same positive NPV, then: A) They also have the same IRR B) They add the same amount to the value of the firm C) They have the same payback period D) They are independent projects Question 3 When estimating the WACC, the weights of debt and equity are based on: A) Initial issue values of a firm's debt and cquity B) Market value of a firm's equity and the face value of its debe C) Book value of a firm's debt and equity D) Market values of a firm's debt and equity Question 4 John Watson plans to have two million dollars al retirement, which is 30 years away. How much does he need to save each year, beginning at the end of this year to reach is target? Assume that the investment found, he will be investing in, could guarantee a 6% annual retum A) $27.36953 B) $25,297.82 C) $27.189.33 D) $26.985.96 Questions Venti Ltd has a cost of cquity of 12%, a pre-tax cost of debt of 7% and a tax rate of 35%. What is the firm's weighted average cost of capital if the debt equity ratio (DE) is 0.6? A) 9.21% B) 10.41% 11.419 D) 11.71%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts