Question: Question 5 a) The expected returns and risks of two securities, X and Y, are given below. If the correlation of the returns on these

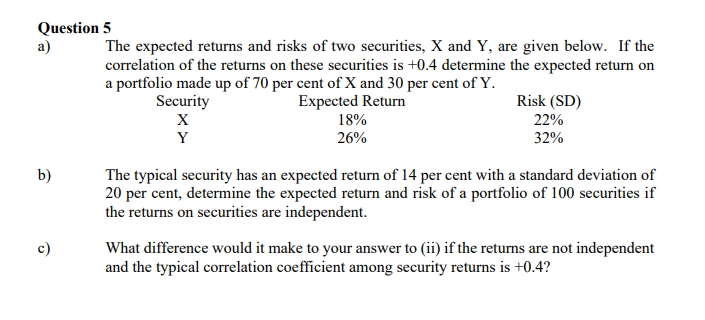

Question 5 a) The expected returns and risks of two securities, X and Y, are given below. If the correlation of the returns on these securities is +0.4 determine the expected return on a portfolio made up of 70 per cent of X and 30 per cent of Y. Security Expected Return Risk (SD) X 18% 22% Y 26% 32% b) The typical security has an expected return of 14 per cent with a standard deviation of 20 per cent, determine the expected return and risk of a portfolio of 100 securities if the returns on securities are independent. What difference would it make to your answer to (ii) if the returns are not independent and the typical correlation coefficient among security returns is +0.4? c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts