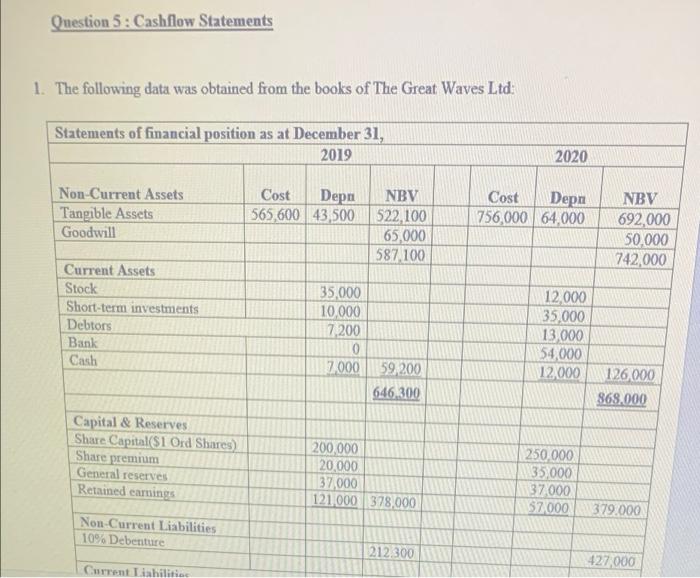

Question: Question 5 : Cashflow Statements 1. The following data was obtained from the books of The Great Waves Ltd Statements of financial position as at

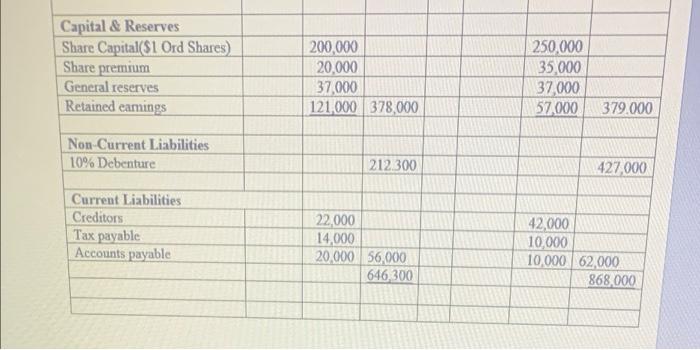

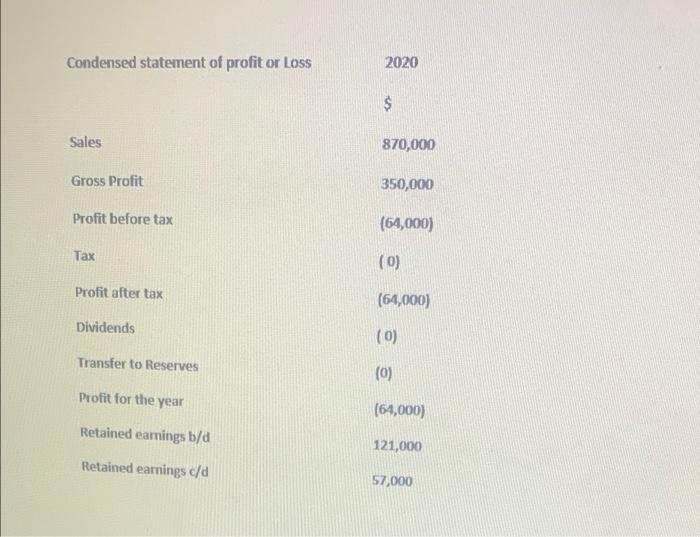

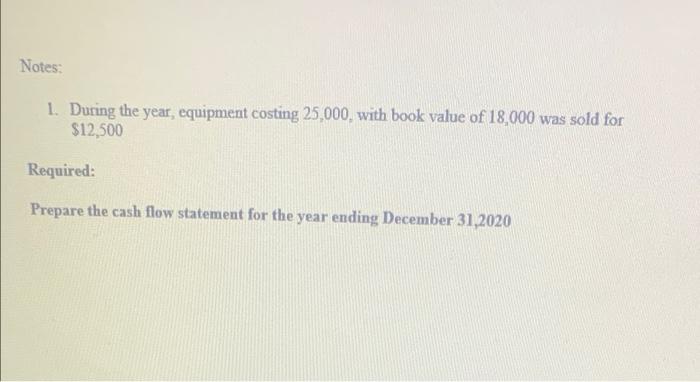

Question 5 : Cashflow Statements 1. The following data was obtained from the books of The Great Waves Ltd Statements of financial position as at December 31, 2019 2020 Non-Current Assets Tangible Assets Goodwill Cost Depni NBV 565,600 43,500 522 100 65,000 587,100 Cost Depn 756,000 64,000 NBV 692,000 50.000 742,000 Current Assets Stock Short-term investments Debtors Bank Cash 35,000 10,000 7200 0 7.000 12,000 35,000 13.000 54,000 12.000 59 200 646 300 126.000 868.000 Capital & Reserves Share Capital (S1 Ord Shares) Share premium General reserves Retained earnings 200,000 20,000 37,000 121.000 378,000 250,000 35,000 37000 57.000 379.000 Non-Current Liabilities 10% Debenture 212.300 427,000 Current Liabilitie Capital & Reserves Share Capital(S1 Ord Shares) Share premium General reserves Retained eamings 200,000 20,000 37,000 121000 378,000 250,000 35,000 37.000 57000 379.000 Non-Current Liabilities 10% Debenture 212.300 427,000 Current Liabilities Creditors Tax payable Accounts payable 22,000 14,000 20,000 56,000 646,300 42,000 10,000 10.000 62.000 868,000 Condensed statement of profit or Loss 2020 $ Sales 870,000 Gross Profit 350,000 Profit before tax (64,000) Tax (0) Profit after tax (64,000) Dividends (0) Transfer to Reserves (0) Profit for the year (64,000) Retained earnings b/d 121,000 Retained earnings c/d 57,000 Notes: 1. During the year, equipment costing 25,000, with book value of 18,000 was sold for $12,500 Required: Prepare the cash flow statement for the year ending December 31,2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts