Question: Question 5 The table below lists statistics for two hedge funds, Bridgewater and Renaissance, as well as the S&P 500 and T-Bills. Which fund performed

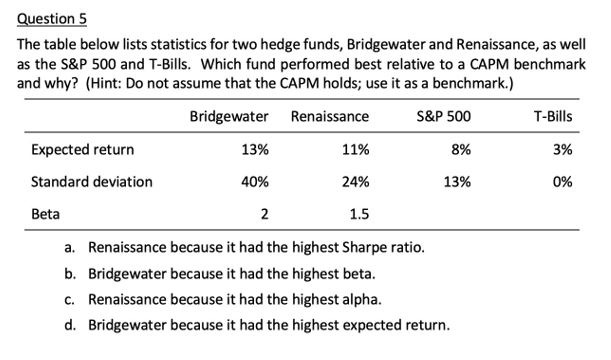

Question 5 The table below lists statistics for two hedge funds, Bridgewater and Renaissance, as well as the S&P 500 and T-Bills. Which fund performed best relative to a CAPM benchmark and why? (Hint: Do not assume that the CAPM holds; use it as a benchmark.) Bridgewater Renaissance S&P 500 T-Bills Expected return 13% 8% 3% 11% Standard deviation 40% 24% 13% 0% Beta 2 1.5 a. Renaissance because it had the highest Sharpe ratio. b. Bridgewater because it had the highest beta. C. Renaissance because it had the highest alpha. d. Bridgewater because it had the highest expected return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts