Question: Question 54 0.59 out of 0.50 points The correlation coefficient of two assets measures the Answers: a The tendency of the two sets to move

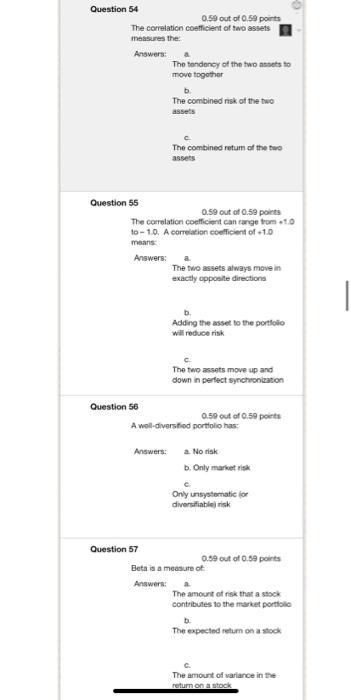

Question 54 0.59 out of 0.50 points The correlation coefficient of two assets measures the Answers: a The tendency of the two sets to move together The combined risk of the two assets The combined return of the two assets Question 55 0.5 out of 0.59 points The correlation coefficient can range from 10 to-1.0. A correlation coefficient of 10 means Answers: a The two assets always move in exactly opposite directions Adding the asset to the portfolio will reduce risk The two assets move up and down in perfect synchronization Question 56 0.59 out of 0.59 points Awal-diversified portfolio has Answers: a Norsk b. Only market c Only unsystematic for diversifiable risk Question 57 0.59 out of 0.6 points Beta is a measure of Answer: The amount of risk that a stock contributes to the market portfolio D. The expected return on a stock The amount of variance in the return on a stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts