Question: Question 6 (1 point) You are provided the monthly returns data for an investment fund and its benchmark for the last five months. The fund

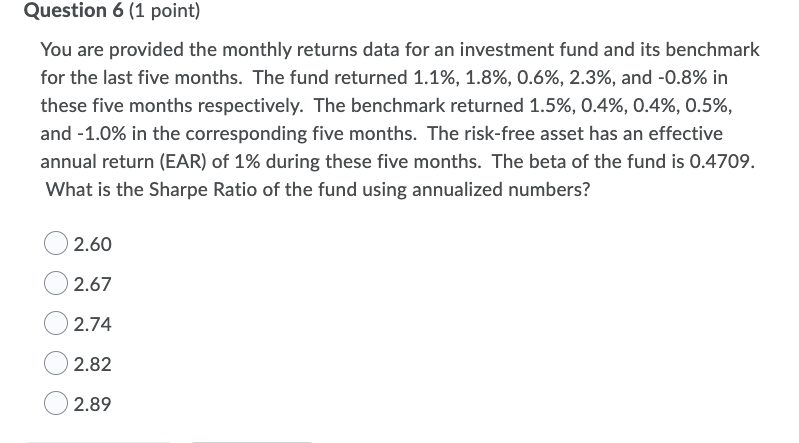

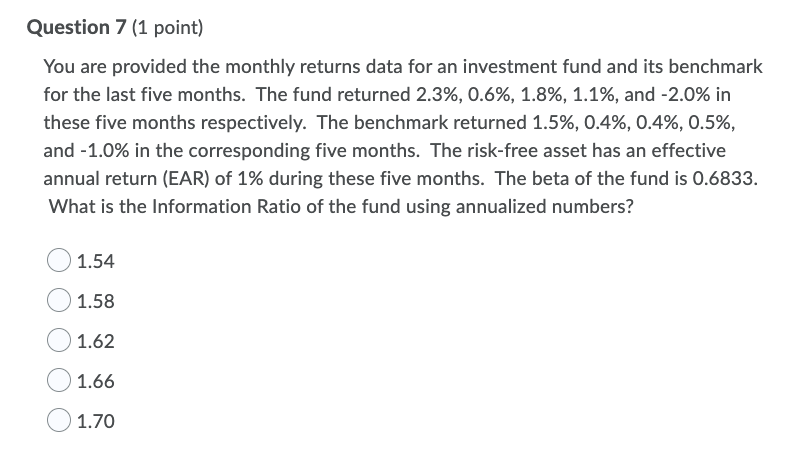

Question 6 (1 point) You are provided the monthly returns data for an investment fund and its benchmark for the last five months. The fund returned 1.1%, 1.8%, 0.6%, 2.3%, and -0.8% in these five months respectively. The benchmark returned 1.5%, 0.4%, 0.4%, 0.5%, and -1.0% in the corresponding five months. The risk-free asset has an effective annual return (EAR) of 1% during these five months. The beta of the fund is 0.4709. What is the Sharpe Ratio of the fund using annualized numbers? 2.60 2.67 2.74 2.82 2.89 Question 7 (1 point) You are provided the monthly returns data for an investment fund and its benchmark for the last five months. The fund returned 2.3%, 0.6%, 1.8%, 1.1%, and -2.0% in these five months respectively. The benchmark returned 1.5%, 0.4%, 0.4%, 0.5%, and -1.0% in the corresponding five months. The risk-free asset has an effective annual return (EAR) of 1% during these five months. The beta of the fund is 0.6833. What is the Information Ratio of the fund using annualized numbers? 1.54 1.58 1.62 1.66 1.70 Question 6 (1 point) You are provided the monthly returns data for an investment fund and its benchmark for the last five months. The fund returned 1.1%, 1.8%, 0.6%, 2.3%, and -0.8% in these five months respectively. The benchmark returned 1.5%, 0.4%, 0.4%, 0.5%, and -1.0% in the corresponding five months. The risk-free asset has an effective annual return (EAR) of 1% during these five months. The beta of the fund is 0.4709. What is the Sharpe Ratio of the fund using annualized numbers? 2.60 2.67 2.74 2.82 2.89 Question 7 (1 point) You are provided the monthly returns data for an investment fund and its benchmark for the last five months. The fund returned 2.3%, 0.6%, 1.8%, 1.1%, and -2.0% in these five months respectively. The benchmark returned 1.5%, 0.4%, 0.4%, 0.5%, and -1.0% in the corresponding five months. The risk-free asset has an effective annual return (EAR) of 1% during these five months. The beta of the fund is 0.6833. What is the Information Ratio of the fund using annualized numbers? 1.54 1.58 1.62 1.66 1.70

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts