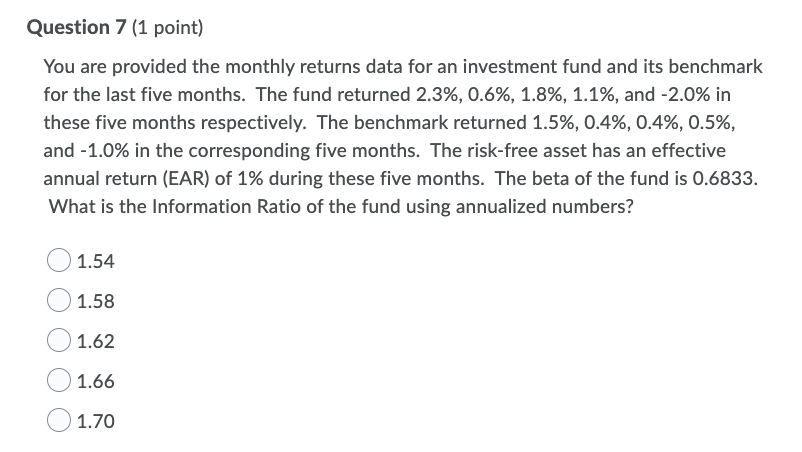

Question: Question 7 (1 point) You are provided the monthly returns data for an investment fund and its benchmark for the last five months. The fund

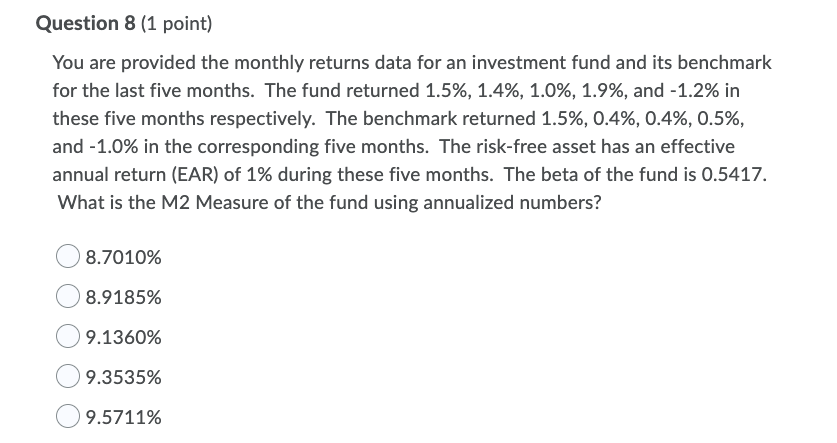

Question 7 (1 point) You are provided the monthly returns data for an investment fund and its benchmark for the last five months. The fund returned 2.3%, 0.6%, 1.8%, 1.1%, and -2.0% in these five months respectively. The benchmark returned 1.5%, 0.4%, 0.4%, 0.5%, and -1.0% in the corresponding five months. The risk-free asset has an effective annual return (EAR) of 1% during these five months. The beta of the fund is 0.6833. What is the Information Ratio of the fund using annualized numbers? 1.54 1.58 1.62 1.66 1.70 Question 8 (1 point) You are provided the monthly returns data for an investment fund and its benchmark for the last five months. The fund returned 1.5%, 1.4%, 1.0%, 1.9%, and -1.2% in these five months respectively. The benchmark returned 1.5%, 0.4%, 0.4%, 0.5%, and - 1.0% in the corresponding five months. The risk-free asset has an effective annual return (EAR) of 1% during these five months. The beta of the fund is 0.5417. What is the M2 Measure of the fund using annualized numbers? 8.7010% 8.9185% 9.1360% 9.3535% 9.5711%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts