Question: Question 9 (1 point) You are provided the monthly returns data for an investment fund and its benchmark for the last five months. The fund

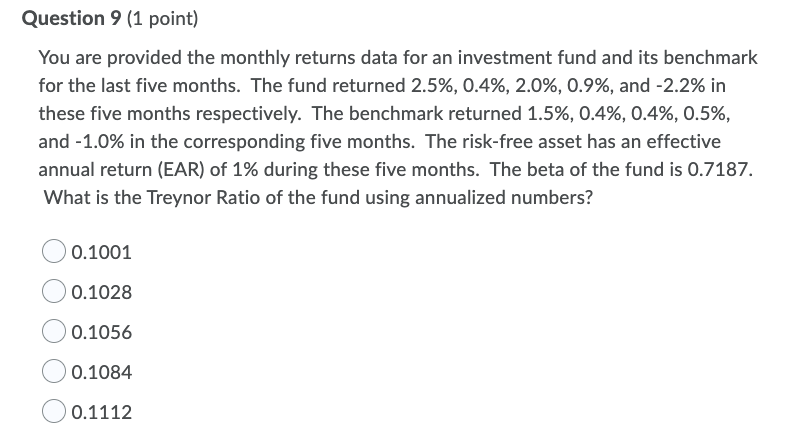

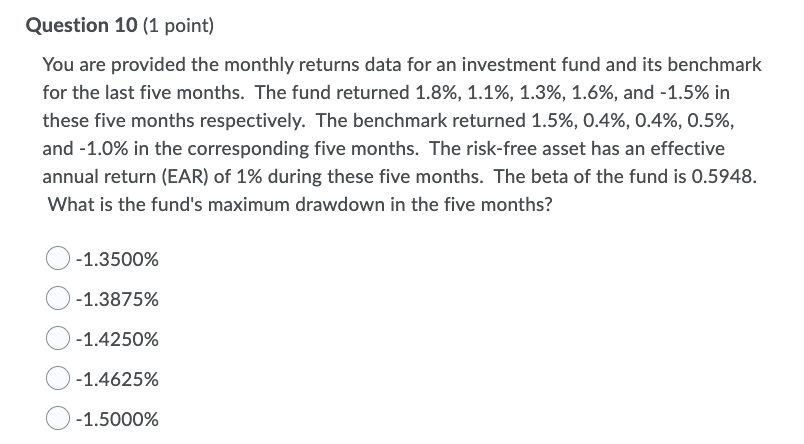

Question 9 (1 point) You are provided the monthly returns data for an investment fund and its benchmark for the last five months. The fund returned 2.5%, 0.4%, 2.0%, 0.9%, and -2.2% in these five months respectively. The benchmark returned 1.5%, 0.4%, 0.4%, 0.5%, and - 1.0% in the corresponding five months. The risk-free asset has an effective annual return (EAR) of 1% during these five months. The beta of the fund is 0.7187. What is the Treynor Ratio of the fund using annualized numbers? 0.1001 0.1028 0.1056 0.1084 0 0.1112 Question 10 (1 point) You are provided the monthly returns data for an investment fund and its benchmark for the last five months. The fund returned 1.8%, 1.1%, 1.3%, 1.6%, and -1.5% in these five months respectively. The benchmark returned 1.5%, 0.4%, 0.4%, 0.5%, and - 1.0% in the corresponding five months. The risk-free asset has an effective annual return (EAR) of 1% during these five months. The beta of the fund is 0.5948. What is the fund's maximum drawdown in the five months? -1.3500% -1.3875% -1.4250% -1.4625% -1.5000% Question 9 (1 point) You are provided the monthly returns data for an investment fund and its benchmark for the last five months. The fund returned 2.5%, 0.4%, 2.0%, 0.9%, and -2.2% in these five months respectively. The benchmark returned 1.5%, 0.4%, 0.4%, 0.5%, and - 1.0% in the corresponding five months. The risk-free asset has an effective annual return (EAR) of 1% during these five months. The beta of the fund is 0.7187. What is the Treynor Ratio of the fund using annualized numbers? 0.1001 0.1028 0.1056 0.1084 0 0.1112 Question 10 (1 point) You are provided the monthly returns data for an investment fund and its benchmark for the last five months. The fund returned 1.8%, 1.1%, 1.3%, 1.6%, and -1.5% in these five months respectively. The benchmark returned 1.5%, 0.4%, 0.4%, 0.5%, and - 1.0% in the corresponding five months. The risk-free asset has an effective annual return (EAR) of 1% during these five months. The beta of the fund is 0.5948. What is the fund's maximum drawdown in the five months? -1.3500% -1.3875% -1.4250% -1.4625% -1.5000%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts