Question: QUESTION 6: (3 + 3 + 3 = 9 marks) Using Excel to do this question a. Consider the 3-year bond from which you receive

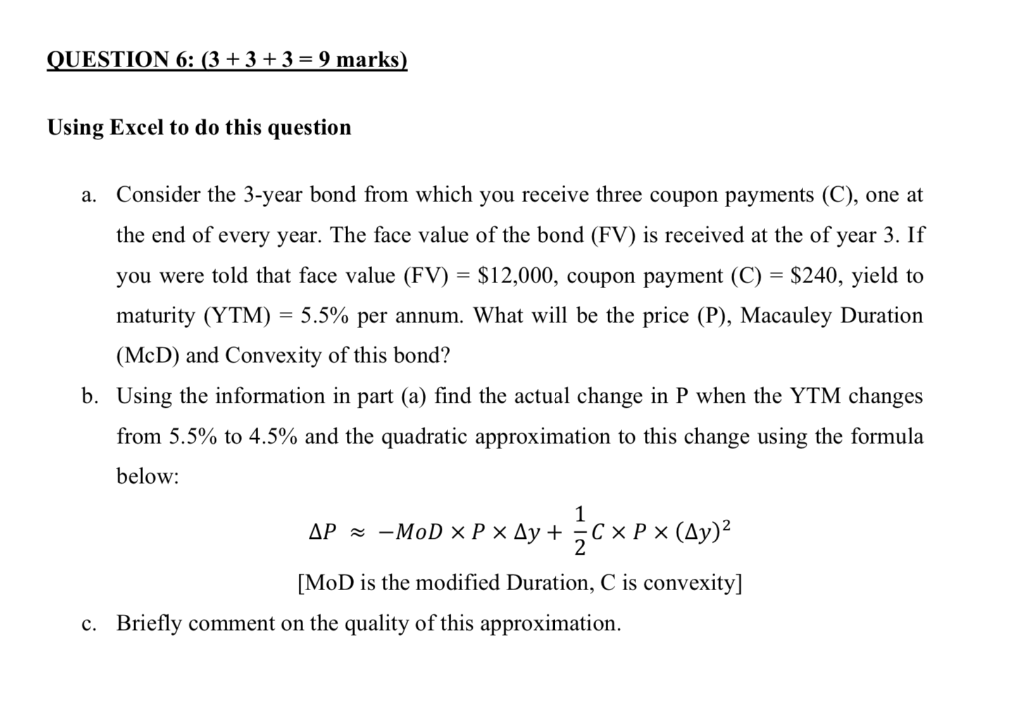

QUESTION 6: (3 + 3 + 3 = 9 marks) Using Excel to do this question a. Consider the 3-year bond from which you receive three coupon payments (C), one at the end of every year. The face value of the bond (FV) is received at the of year 3. If you were told that face value (FV) = $12,000, coupon payment (C) = $240, yield to maturity (YTM) = 5.5% per annum. What will be the price (P), Macauley Duration (McD) and Convexity of this bond? b. Using the information in part (a) find the actual change in P when the YTM changes from 5.5% to 4.5% and the quadratic approximation to this change using the formula below: 1 AP ~ -MoD x P x Ay + 50 x P x (Ay)2 cx ? [MoD is the modified Duration, C is convexity] c. Briefly comment on the quality of this approximation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts