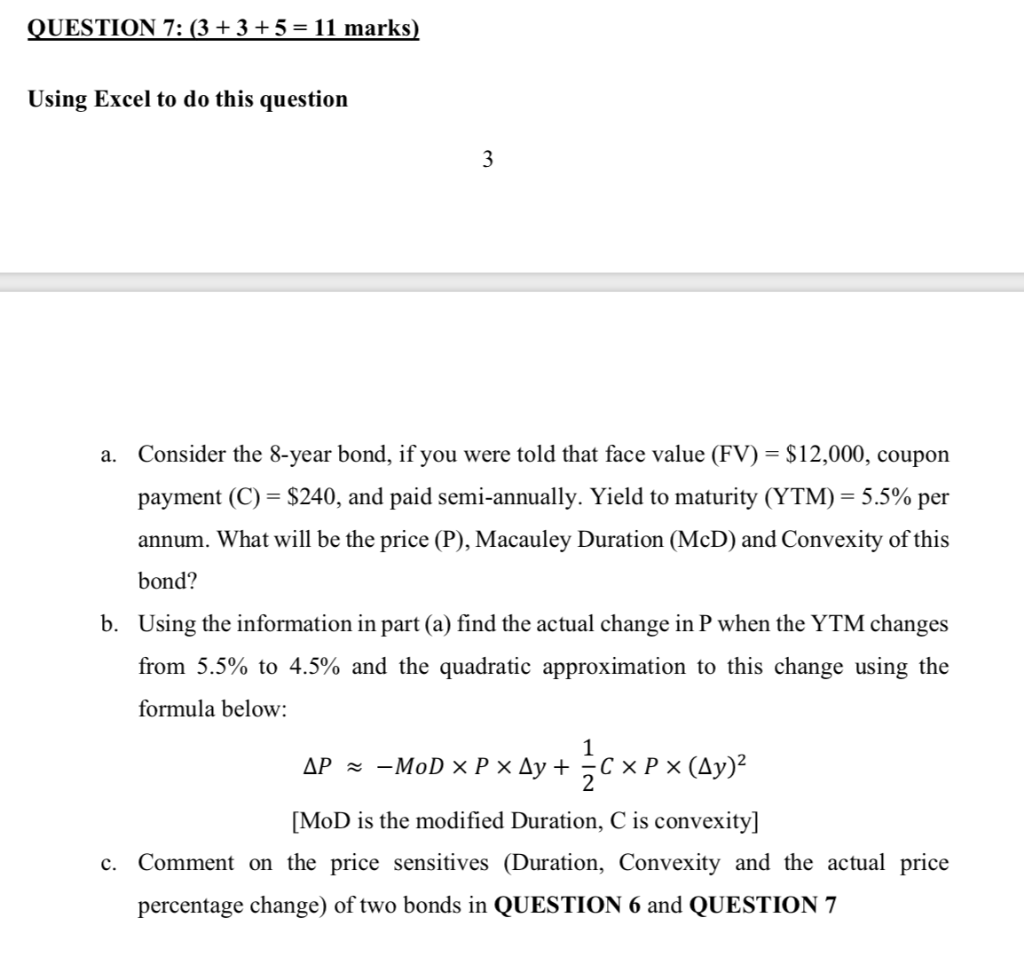

Question: QUESTION 7: (3 + 3 + 5 = 11 marks) Using Excel to do this question 3 a. Consider the 8-year bond, if you were

QUESTION 7: (3 + 3 + 5 = 11 marks) Using Excel to do this question 3 a. Consider the 8-year bond, if you were told that face value (FV) = $12,000, coupon payment (C) = $240, and paid semi-annually. Yield to maturity (YTM) = 5.5% per annum. What will be the price (P), Macauley Duration (McD) and Convexity of this bond? b. Using the information in part (a) find the actual change in P when the YTM changes from 5.5% to 4.5% and the quadratic approximation to this change using the formula below: AP -MoD x P x Ay + +{cxpx (A1) c. [MoD is the modified Duration, C is convexity] Comment on the price sensitives (Duration, Convexity and the actual price percentage change) of two bonds in QUESTION 6 and QUESTION 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts