Question: Question 6 (5 points) You are given two risky assets. The first is a stock fund and the second is a bond fund. A T-bill

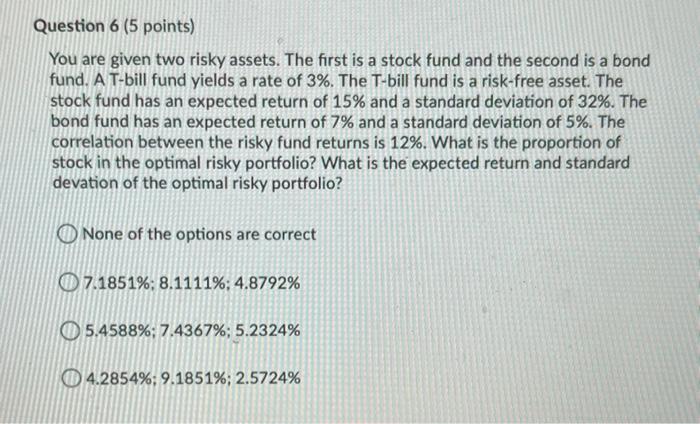

Question 6 (5 points) You are given two risky assets. The first is a stock fund and the second is a bond fund. A T-bill fund yields a rate of 3%. The T-bill fund is a risk-free asset. The stock fund has an expected return of 15% and a standard deviation of 32%. The bond fund has an expected return of 7% and a standard deviation of 5%. The correlation between the risky fund returns is 12%. What is the proportion of stock in the optimal risky portfolio? What is the expected return and standard devation of the optimal risky portfolio? None of the options are correct 07.1851%; 8.1111%; 4.8792% 05.4588%; 7.4367%; 5.2324% 4.2854%; 9.1851%; 2.5724%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts