Question: Question 6 (5 points) You are given two risky assets. The first is a stock fund and the second is a bond fund. A T-bill

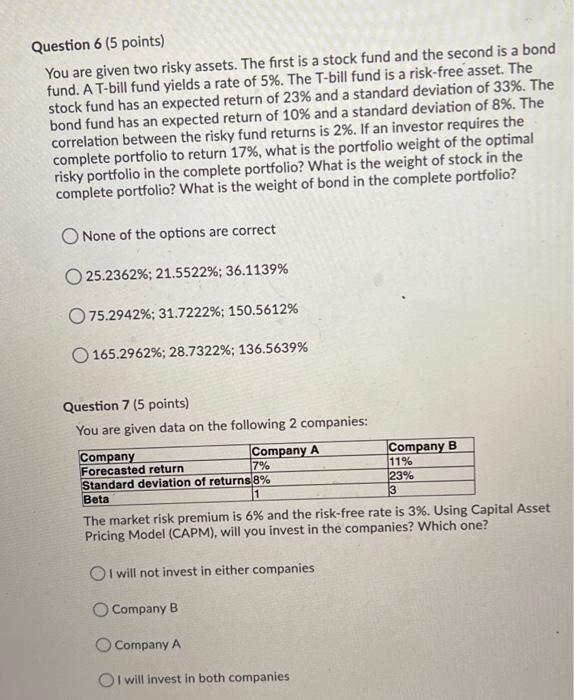

Question 6 (5 points) You are given two risky assets. The first is a stock fund and the second is a bond fund. A T-bill fund yields a rate of 5%. The T-bill fund is a risk-free asset. The stock fund has an expected return of 23% and a standard deviation of 33%. The bond fund has an expected return of 10% and a standard deviation of 8%. The correlation between the risky fund returns is 2%. If an investor requires the complete portfolio to return 17%, what is the portfolio weight of the optimal risky portfolio in the complete portfolio? What is the weight of stock in the complete portfolio? What is the weight of bond in the complete portfolio? O None of the options are correct 25.2362%; 21.5522%; 36.1139% 075.2942%: 31.7222%; 150.5612% 165.2962%; 28.7322%; 136.5639% Question 7 (5 points) You are given data on the following 2 companies: Company Company A Company B Forecasted return 7% 11% Standard deviation of returns 8% 23% Beta 3 The market risk premium is 6% and the risk-free rate is 3%. Using Capital Asset Pricing Model (CAPM), will you invest in the companies? Which one? 1 I will not invest in either companies Company B Company A I will invest in both companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts