Question: Question 8 (5 points) You are given two risky assets. The first is a stock fund and the second is a bond fund. A T-bill

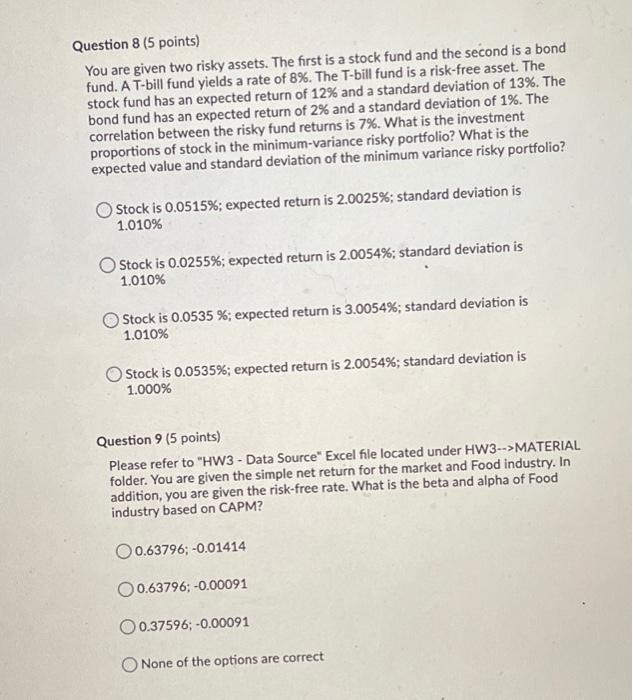

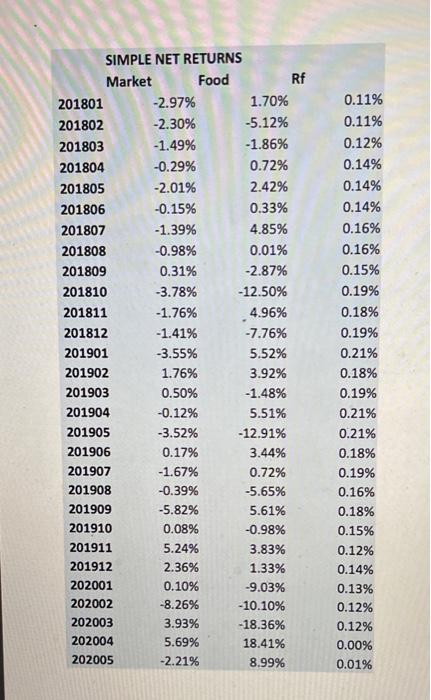

Question 8 (5 points) You are given two risky assets. The first is a stock fund and the second is a bond fund. A T-bill fund yields a rate of 8%. The T-bill fund is a risk-free asset. The stock fund has an expected return of 12% and a standard deviation of 13%. The bond fund has an expected return of 2% and a standard deviation of 1%. The correlation between the risky fund returns is 7%. What is the investment proportions of stock in the minimum-variance risky portfolio? What is the expected value and standard deviation of the minimum variance risky portfolio? Stock is 0.0515%; expected return is 2.0025%; standard deviation is 1.010% Stock is 0.0255%; expected return is 2.0054%; standard deviation is 1.010% Stock is 0.0535 %; expected return is 3.0054%; standard deviation is 1.010% Stock is 0.0535%; expected return is 2.0054%; standard deviation is 1.000% Question 9 (5 points) Please refer to "HW3 - Data Source" Excel file located under HW3-->MATERIAL folder. You are given the simple net return for the market and Food industry. In addition, you are given the risk-free rate. What is the beta and alpha of Food industry based on CAPM? O 0.63796; -0.01414 0.63796; -0.00091 O 0.37596; -0.00091 None of the options are correct SIMPLE NET RETURNS Rf 1.70% 0.11% Market Food 201801 -2.97% 201802 -2.30% 201803 -1.49% -5.12% 0.11% -1.86% 0.12% 201804 -0.29% 0.72% 0.14% 201805 -2.01% 2.42% 0.14% 201806 -0.15% 0.33% 0.14% 201807 -1.39% 4.85% 0.16% 201808 -0.98% 0.01% 0.16% 201809 0.31% -2.87% 0.15% 201810 -3.78% -12.50% 0.19% 201811 -1.76% 4.96% 0.18% 201812 -1.41% -7.76% 0.19% 201901 -3.55% 5.52% 0.21% 201902 1.76% 3.92% 0.18% 201903 0.50% -1.48% 0.19% 201904 -0.12% 5.51% 0.21% 201905 -3.52% -12.91% 0.21% 201906 0.17% 3.44% 0.18% 201907 -1.67% 0.72% 0.19% 201908 -0.39% -5.65% 0.16% 201909 -5.82% 5.61% 0.18% 201910 0.08% -0.98% 0.15% 201911 5.24% 3.83% 0.12% 201912 2.36% 1.33% 0.14% 202001 0.10% -9.03% 0.13% 202002 -8.26% - 10.10% 0.12% 202003 3.93% -18.36% 0.12% 202004 5.69% 18.41% 0.00% 202005 -2.21% 8.99% 0.01%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts