Question: QUESTION 6, 7 Example 6 Suppose we are given the following bid books for Market A and Market B: Bid 50.4 50.39 50.38 Market A

QUESTION 6, 7

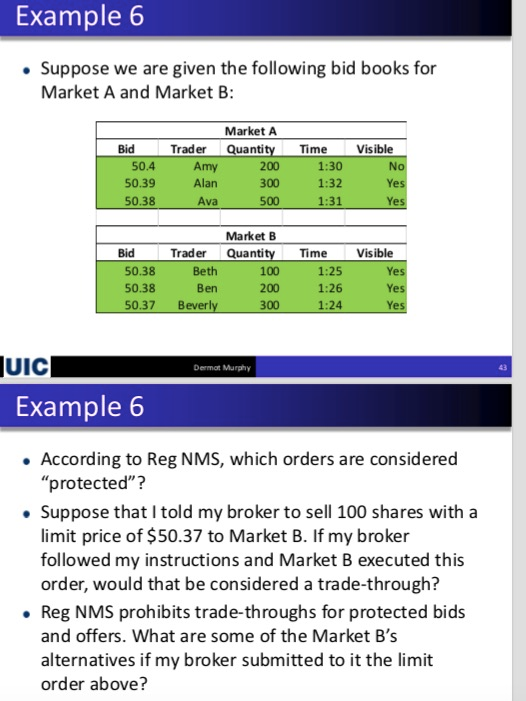

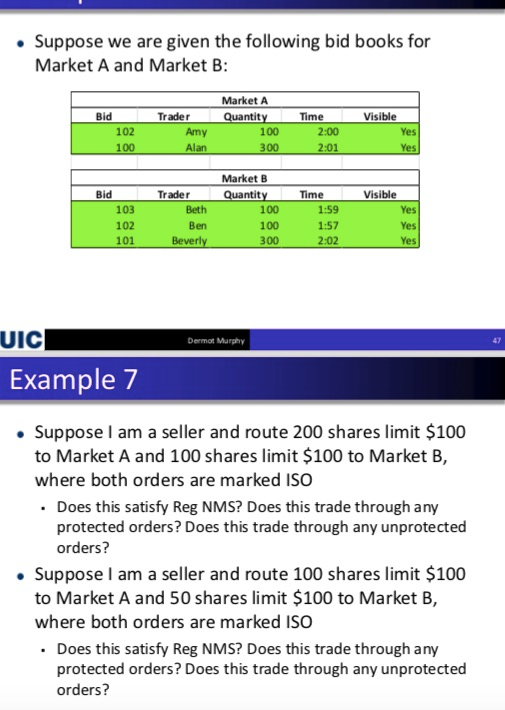

Example 6 Suppose we are given the following bid books for Market A and Market B: Bid 50.4 50.39 50.38 Market A Trader Quantity Amy 200 Alan 300 Ava 500 Time 1:30 1:32 1:31 Visible No Yes Yes Bid 50.38 50.38 50.37 Trader Beth Ben Beverly Market B Quantity 100 200 300 Time 1:25 1 :26 1:24 Visible Yes Yes Yes Dermot Murphy JUIC Example 6 According to Reg NMS, which orders are considered "protected"? Suppose that I told my broker to sell 100 shares with a limit price of $50.37 to Market B. If my broker followed my instructions and Market B executed this order, would that be considered a trade-through? Reg NMS prohibits trade-throughs for protected bids and offers. What are some of the Market B's alternatives if my broker submitted to it the limit order above? Suppose we are given the following bid books for Market A and Market B: Visible Market A Quantity 100 300 Trader Amy Alan 102 Time 2:00 2:01 100 Visible 103 Trader Beth Ben Beverly Market B Quantity Time 100 1001:57 300 102 101 2:02 Yes Dermor Murphy UIC Example 7 Suppose I am a seller and route 200 shares limit $100 to Market A and 100 shares limit $100 to Market B, where both orders are marked ISO . Does this satisfy Reg NMS? Does this trade through any protected orders? Does this trade through any unprotected orders? Suppose I am a seller and route 100 shares limit $100 to Market A and 50 shares limit $100 to Market B, where both orders are marked ISO Does this satisfy Reg NMS? Does this trade through any protected orders? Does this trade through any unprotected orders? Example 6 Suppose we are given the following bid books for Market A and Market B: Bid 50.4 50.39 50.38 Market A Trader Quantity Amy 200 Alan 300 Ava 500 Time 1:30 1:32 1:31 Visible No Yes Yes Bid 50.38 50.38 50.37 Trader Beth Ben Beverly Market B Quantity 100 200 300 Time 1:25 1 :26 1:24 Visible Yes Yes Yes Dermot Murphy JUIC Example 6 According to Reg NMS, which orders are considered "protected"? Suppose that I told my broker to sell 100 shares with a limit price of $50.37 to Market B. If my broker followed my instructions and Market B executed this order, would that be considered a trade-through? Reg NMS prohibits trade-throughs for protected bids and offers. What are some of the Market B's alternatives if my broker submitted to it the limit order above? Suppose we are given the following bid books for Market A and Market B: Visible Market A Quantity 100 300 Trader Amy Alan 102 Time 2:00 2:01 100 Visible 103 Trader Beth Ben Beverly Market B Quantity Time 100 1001:57 300 102 101 2:02 Yes Dermor Murphy UIC Example 7 Suppose I am a seller and route 200 shares limit $100 to Market A and 100 shares limit $100 to Market B, where both orders are marked ISO . Does this satisfy Reg NMS? Does this trade through any protected orders? Does this trade through any unprotected orders? Suppose I am a seller and route 100 shares limit $100 to Market A and 50 shares limit $100 to Market B, where both orders are marked ISO Does this satisfy Reg NMS? Does this trade through any protected orders? Does this trade through any unprotected orders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts