Question: Question 6 9 2 pts David Cahn from Sequoia Capital ( Venture Capital ) authored a piece regarding the potential Al bubble developing with the

Question

pts

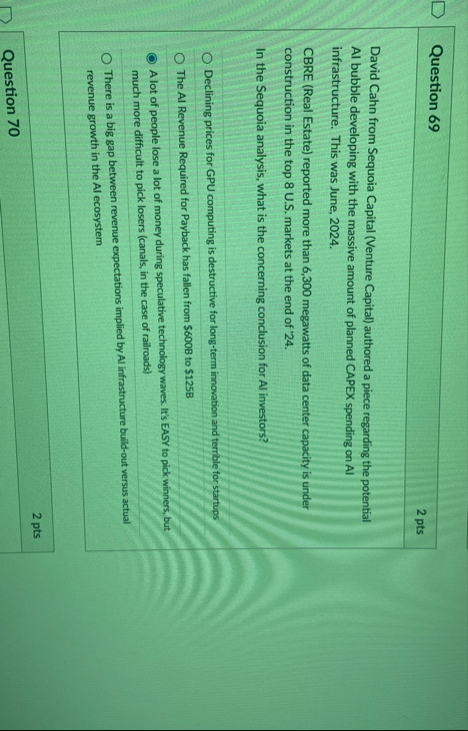

David Cahn from Sequoia Capital Venture Capital authored a piece regarding the potential Al bubble developing with the massive amount of planned CAPEX spending on AI infrastructure. This was June,

CBRE Real Estate reported more than megawatts of data center capacity is under construction in the top US markets at the end of

In the Sequoia analysis, what is the concerning conclusion for Al investors?

Declining prices for GPU computing is destructive for longterm innovation and terrible for startups

The At Revenue Required for Payback has fallen from $ to $

A lot of people lose a lot of money during speculative technology waves. It's EASY to pick winners, but much more difficult to pick losers canals in the case of railroads

There is a big gap between revenue expectations implied by Al infrastructure buildout versus actual revenue growth in the Al ecosystem

pts

Question

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock