Question: Question 6 e Glenealy Berhad had $50 million (face value) of convertible bonds outstanding in 2019. Each bond has the following features: Par or face

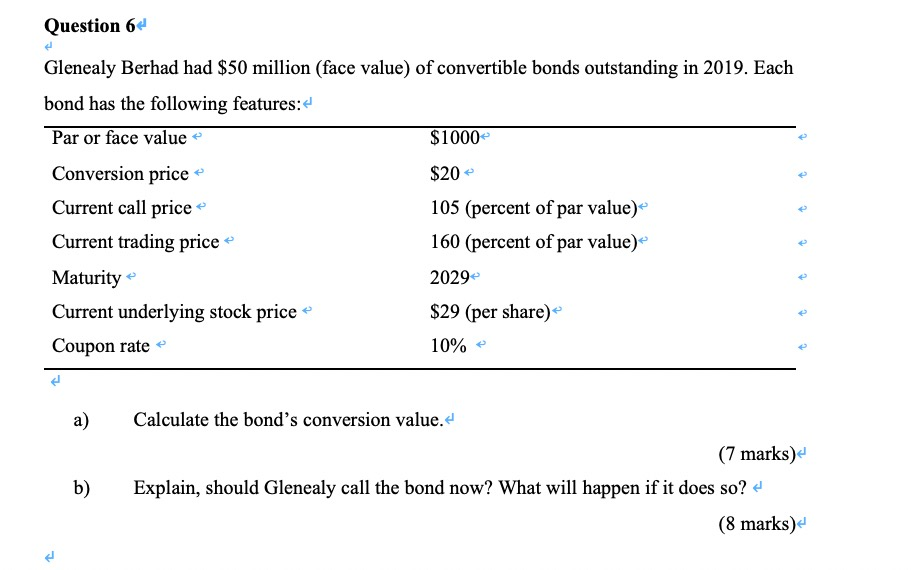

Question 6 e Glenealy Berhad had $50 million (face value) of convertible bonds outstanding in 2019. Each bond has the following features: Par or face value $1000 Conversion price $20 Current call price 105 (percent of par value) Current trading price 160 (percent of par value) Maturity 2029 Current underlying stock price $29 (per share) Coupon rate 10% e e a) Calculate the bond's conversion value. (7 marks) Explain, should Glenealy call the bond now? What will happen if it does so? + (8 marks) b) Question 6 e Glenealy Berhad had $50 million (face value) of convertible bonds outstanding in 2019. Each bond has the following features: Par or face value $1000 Conversion price $20 Current call price 105 (percent of par value) Current trading price 160 (percent of par value) Maturity 2029 Current underlying stock price $29 (per share) Coupon rate 10% e e a) Calculate the bond's conversion value. (7 marks) Explain, should Glenealy call the bond now? What will happen if it does so? + (8 marks) b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts