Question: Question 6 Quest Exploration Ltd is trying to take advantage of the commodity boom by increasing its exploration activities. However, as a junior mining company

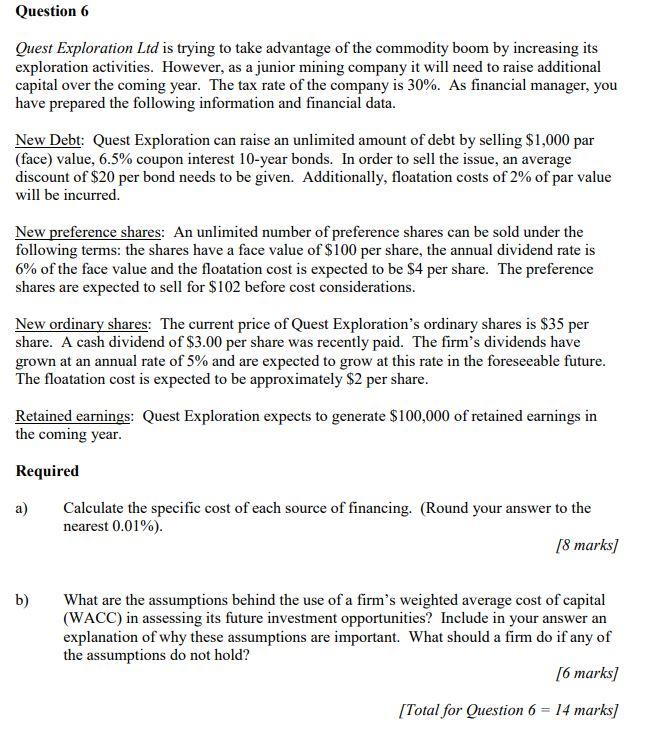

Question 6 Quest Exploration Ltd is trying to take advantage of the commodity boom by increasing its exploration activities. However, as a junior mining company it will need to raise additional capital over the coming year. The tax rate of the company is 30%. As financial manager, you have prepared the following information and financial data. New Debt: Quest Exploration can raise an unlimited amount of debt by selling $1,000 par (face) value, 6.5% coupon interest 10-year bonds. In order to sell the issue, an average discount of $20 per bond needs to be given. Additionally, floatation costs of 2% of par value will be incurred. New preference shares: An unlimited number of preference shares can be sold under the following terms: the shares have a face value of $100 per share, the annual dividend rate is 6% of the face value and the floatation cost is expected to be $4 per share. The preference shares are expected to sell for $102 before cost considerations. New ordinary shares: The current price of Quest Exploration's ordinary shares is $35 per share. A cash dividend of $3.00 per share was recently paid. The firm's dividends have grown at an annual rate of 5% and are expected to grow at this rate in the foreseeable future. The floatation cost is expected to be approximately $2 per share. Retained earnings: Quest Exploration expects to generate $100,000 of retained earnings in the coming year. Required a) Calculate the specific cost of each source of financing. (Round your answer to the nearest 0.01%). (8 marks] b) What are the assumptions behind the use of a firm's weighted average cost of capital (WACC) in assessing its future investment opportunities? Include in your answer an explanation of why these assumptions are important. What should a firm do if any of the assumptions do not hold? [6 marks] [Total for Question 6 = 14 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts