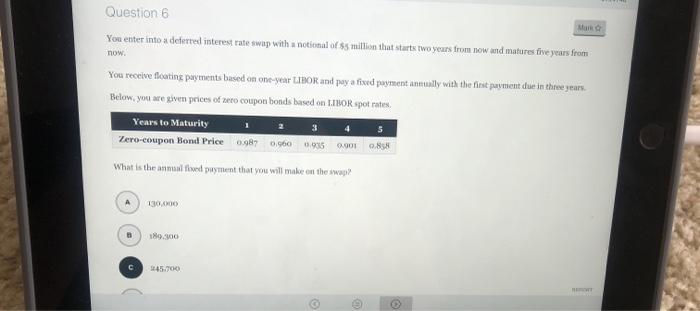

Question: Question 6 You enter into a deferred interest rate swap with a national of $5 million that starts two years from now and matures five

Question 6 You enter into a deferred interest rate swap with a national of $5 million that starts two years from now and matures five years from now. You receive floating payments based om oneyear LIBOR and pay a fixed payment annually with the first payment due in three years Below, you are given prices of peo coupon bonds based on LIBOR spot rates, Years to Maturity Zero-coupon Bond Price 0.98 0.00 0.00 0.00 0.88 What is the annual loved payment that you will make on the way 2 3 5 18. 9:45.700 Question 6 You enter into a deferred interest rate swap with a national of $5 million that starts two years from now and matures five years from now. You receive floating payments based om oneyear LIBOR and pay a fixed payment annually with the first payment due in three years Below, you are given prices of peo coupon bonds based on LIBOR spot rates, Years to Maturity Zero-coupon Bond Price 0.98 0.00 0.00 0.00 0.88 What is the annual loved payment that you will make on the way 2 3 5 18. 9:45.700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts