Question: You enter into a deferred interest rate swap with a notional of $5 million that starts two years from now and matures five years from

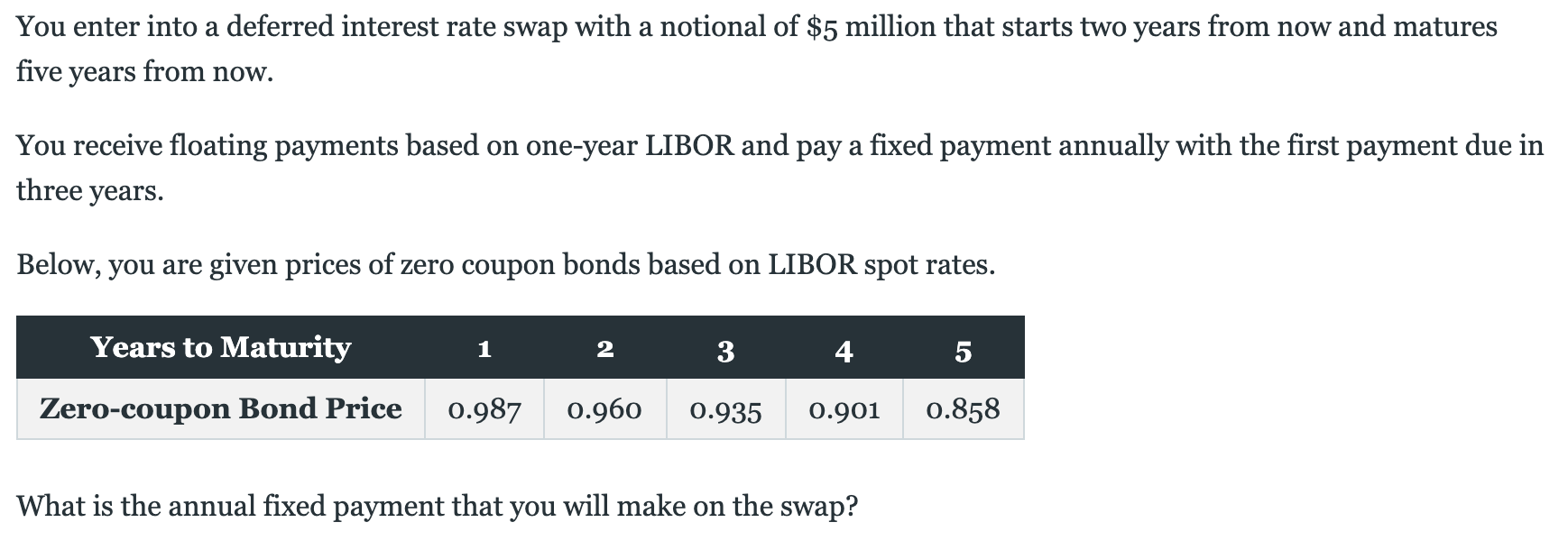

You enter into a deferred interest rate swap with a notional of $5 million that starts two years from now and matures five years from now. You receive floating payments based on one-year LIBOR and pay a fixed payment annually with the first payment due in three years. Below, you are given prices of zero coupon bonds based on LIBOR spot rates. Years to Maturity 1 2 3 4 5 Zero-coupon Bond Price 0.987 0.960 0.935 0.901 0.858 What is the annual fixed payment that you will make on the swap?

You enter into a deferred interest rate swap with a notional of $5 million that starts two years from now and matures five years from now. You receive floating payments based on one-year LIBOR and pay a fixed payment annually with the first payment due in three years. Below, you are given prices of zero coupon bonds based on LIBOR spot rates. Years to Maturity 1 2 3 4 5 Zero-coupon Bond Price 0.987 0.960 0.935 0.901 0.858 What is the annual fixed payment that you will make on the swap?

a)130,000

b)189,300

c)245,700

d)263,500

e)432,900

You enter into a deferred interest rate swap with a notional of $5 million that starts two years from now and matures five years from now. You receive floating payments based on one-year LIBOR and pay a fixed payment annually with the first payment due in three years. Below, you are given prices of zero coupon bonds based on LIBOR spot rates. Years to Maturity 1 3 4 5 Zero-coupon Bond Price 0.987 0.960 0.935 0.901 0.858 What is the annual fixed payment that you will make on the swap? You enter into a deferred interest rate swap with a notional of $5 million that starts two years from now and matures five years from now. You receive floating payments based on one-year LIBOR and pay a fixed payment annually with the first payment due in three years. Below, you are given prices of zero coupon bonds based on LIBOR spot rates. Years to Maturity 1 3 4 5 Zero-coupon Bond Price 0.987 0.960 0.935 0.901 0.858 What is the annual fixed payment that you will make on the swap

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts