Question: You enter into a deferred interest rate swap with a notional of $5 million that starts two years from now and matures five years from

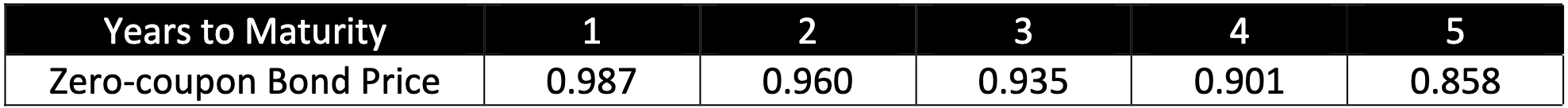

You enter into a deferred interest rate swap with a notional of $5 million that starts two years from now and matures five years from now. You receive floating payments based on one-year LIBOR and pay a fixed payment annually with the first payment due in three years. Below, you are given prices of zero coupon bonds based on LIBOR spot rates.

What is the annual fixed payment that you will make on the swap?

A. 130,000 B. 189,300 C. 245,700 D. 263,500 E. 432,900

1 3 4 Years to Maturity Zero-coupon Bond Price 2 0.960 5 0.858 0.987 0.935 0.901

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock