Question: Question 7 (10 points) During the class, we talked about how to construct Bull Spread trading strategy using calls on the same stock with the

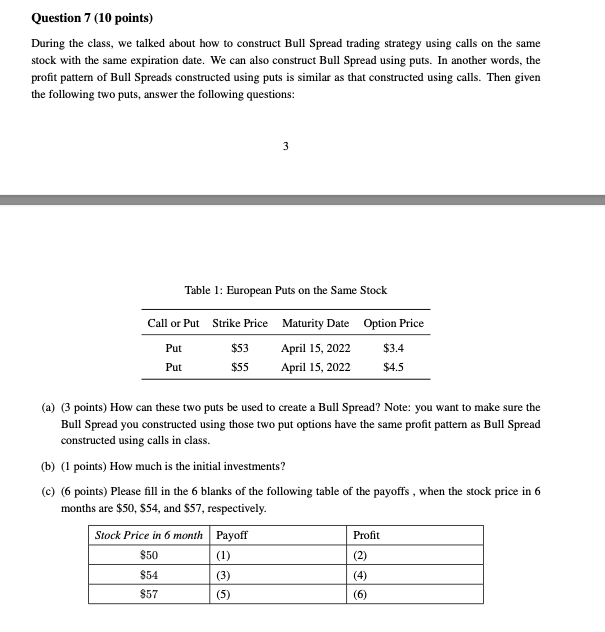

Question 7 (10 points) During the class, we talked about how to construct Bull Spread trading strategy using calls on the same stock with the same expiration date. We can also construct Bull Spread using puts. In another words, the profit pattern of Bull Spreads constructed using puts is similar as that constructed using calls. Then given the following two puts, answer the following questions: 3 Table 1: European Puts on the Same Stock Call or Put Strike Price Maturity Date Option Price Put $53 April 15, 2022 $3.4 Put $55 April 15, 2022 $4.5 (a) (3 points) How can these two puts be used to create a Bull Spread? Note: you want to make sure the Bull Spread you constructed using those two put options have the same profit pattern as Bull Spread constructed using calls in class. (b) (1 points) How much is the initial investments? (c) (6 points) Please fill in the 6 blanks of the following table of the payoffs , when the stock price in 6 months are $50, 554, and $57, respectively. Stock Price in 6 month Payoff Profit $50 (1) (2) $54 (5) (3) (4) $57 (6)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts