Question: QUESTION 7 A company is evaluating a project that will increase sales by $252,449 and costs by $174,000. The project will initially cost $460,000 for

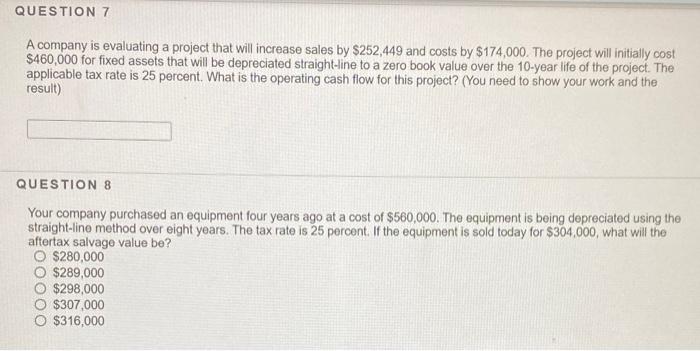

QUESTION 7 A company is evaluating a project that will increase sales by $252,449 and costs by $174,000. The project will initially cost $460,000 for fixed assets that will be depreciated straight-line to a zero book value over the 10-year life of the project. The applicable tax rate is 25 percent. What is the operating cash flow for this project? (You need to show your work and the result) QUESTION 8 Your company purchased an equipment four years ago at a cost of $560,000. The equipment is being depreciated using the straight-line method over eight years. The tax rate is 25 percent. If the equipment is sold today for $304.000, what will the aftertax salvage value be? O $280,000 O $289,000 $298,000 $307,000 $316,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts