Question: QUESTION 16 An enterpise is evaluating a project that will increase sales by $488,000 and costs by $261,000. The project will initially cost $1,782,000 for

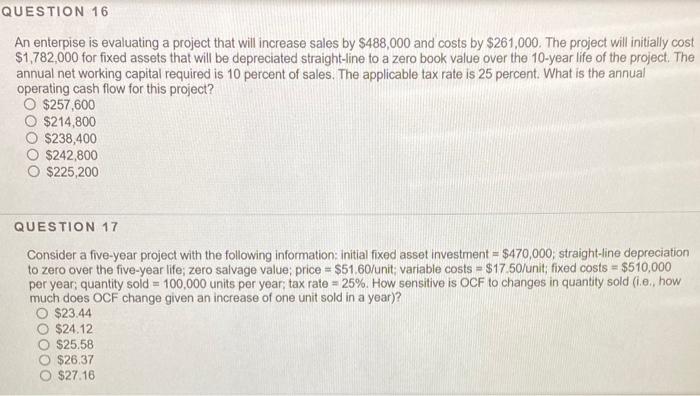

QUESTION 16 An enterpise is evaluating a project that will increase sales by $488,000 and costs by $261,000. The project will initially cost $1,782,000 for fixed assets that will be depreciated straight-line to a zero book value over the 10-year life of the project. The annual net working capital required is 10 percent of sales. The applicable tax rate is 25 percent. What is the annual operating cash flow for this project? $257,600 $214,800 $238,400 O $242,800 $225,200 QUESTION 17 Consider a five-year project with the following information: initial fixed asset investment = $470,000, straight-line depreciation to zero over the five-year life; zero salvage value; price = $51.60/unit: variable costs - $17.50/unit; fixed costs - $510,000 per year; quantity sold - 100,000 units per year; tax rate - 25%. How sensitive is OCF to changes in quantity sold (i.e. how much does OCF change given an increase of one unit sold in a year)? O $23.44 $24.12 $25.58 $26.37 O $27.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts