Question: Question 7 A fund manager is trying to construct a diversified portfolio, which contains stock and bond indices. Collecting and analysing monthly data for each

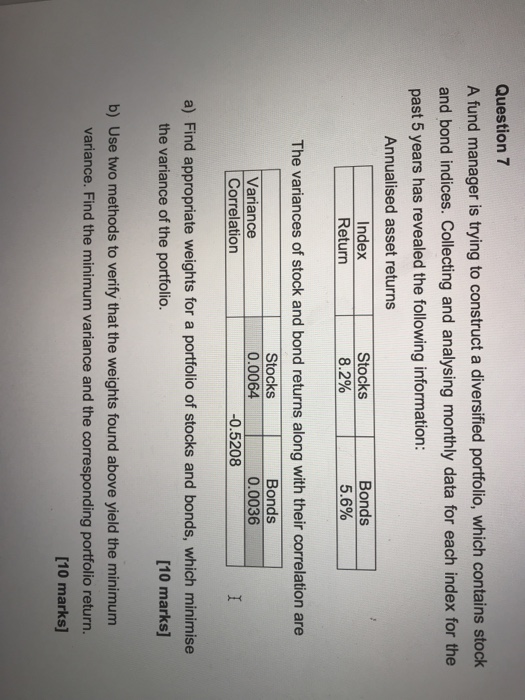

Question 7 A fund manager is trying to construct a diversified portfolio, which contains stock and bond indices. Collecting and analysing monthly data for each index for the past 5 years has revealed the following information: Annualised asset returns Index Stocks Bonds Return | 8.2% | 5.6% The variances of stock and bond returns along with their correlation are Stocks 0.0064 Bonds 0.0036 Variance Correlation 0.5208 a) Find appropriate weights for a portfolio of stocks and bonds, which minimise the variance of the portfolio. [10 marks] b) Use two methods to verify that the weights found above yield the minimum variance. Find the minimum variance and the corresponding portfolio return. [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts