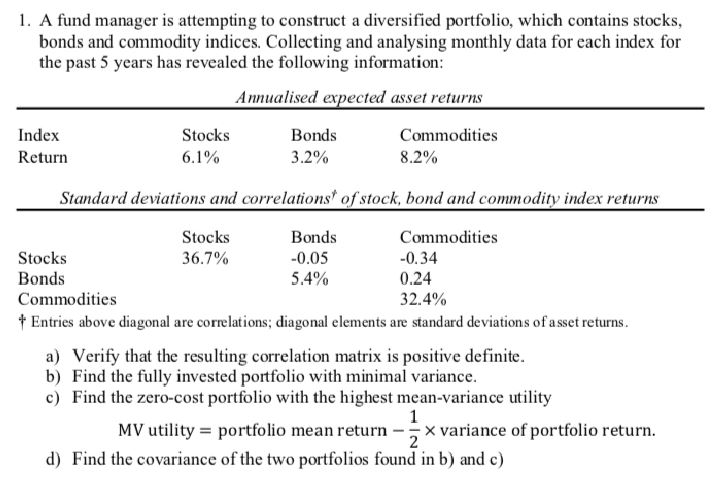

Question: 1. A fund manager is attempting to construct a diversified portfolio, which contains stocks, bonds and commodity indices. Collecting and analysing monthly data for each

1. A fund manager is attempting to construct a diversified portfolio, which contains stocks, bonds and commodity indices. Collecting and analysing monthly data for each index for the past 5 years has revealed the following information Annualised expected asset returns Index Return Stocks 6.1% Bonds 3.2% Commodities 8.2% Standard deviations and correlations of stock, bond and commodity index returns Stocks Bonds Commodities Stocks 36.7% Bonds 0.05 5.4% Commodities 0.34 0.24 32.4% Entries above diagonal are correlations; diagonal elements are standard deviations of asset returns a) Verify that the resulting correlation matrix is positive definite. b) Find the fully invested portfolio with minimal variance c) Find the zero-cost portfolio with the highest mean-variance utility MV utility- portfolio mean returnX d) Find the covariance of the two portfolios found in b) and c) variance of portfolio return 1. A fund manager is attempting to construct a diversified portfolio, which contains stocks, bonds and commodity indices. Collecting and analysing monthly data for each index for the past 5 years has revealed the following information Annualised expected asset returns Index Return Stocks 6.1% Bonds 3.2% Commodities 8.2% Standard deviations and correlations of stock, bond and commodity index returns Stocks Bonds Commodities Stocks 36.7% Bonds 0.05 5.4% Commodities 0.34 0.24 32.4% Entries above diagonal are correlations; diagonal elements are standard deviations of asset returns a) Verify that the resulting correlation matrix is positive definite. b) Find the fully invested portfolio with minimal variance c) Find the zero-cost portfolio with the highest mean-variance utility MV utility- portfolio mean returnX d) Find the covariance of the two portfolios found in b) and c) variance of portfolio return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts