Question: Question 7 Choose the most accurate statement Not yet Marked out of 0.50 F Flag question Select one a. Systematic risks cannot be avoided by

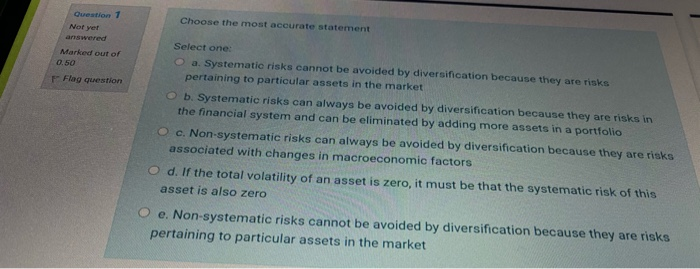

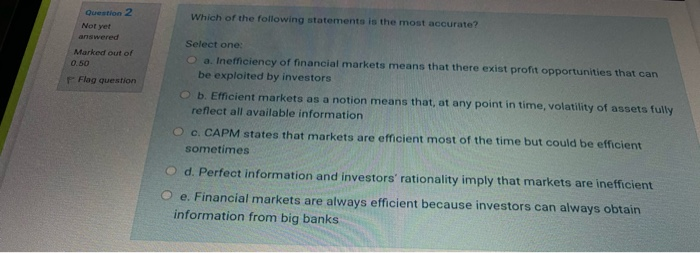

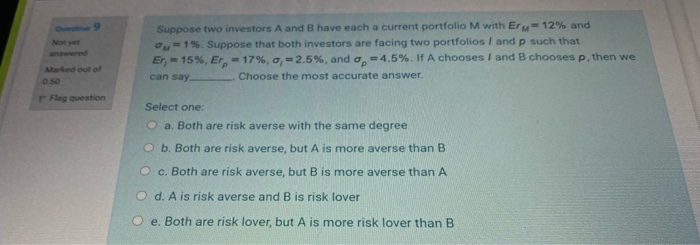

Question 7 Choose the most accurate statement Not yet Marked out of 0.50 F Flag question Select one a. Systematic risks cannot be avoided by diversification because they are risks pertaining to particular assets in the market b. Systematic risks can always be avoided by diversification because they are risks in the financial system and can be eliminated by adding more assets in a portfolio c. Non-systematic risks can always be avoided by diversification because they are risks associated with changes in macroeconomic factors Od. If the total volatility of an asset is zero, it must be that the systematic risk of this asset is also zero e. Non-systematic risks cannot be avoided by diversification because they are risks pertaining to particular assets in the market Question 2 Which of the following statements is the most accurate? Not yet answered Marked out of 0.50 P Flag question Select one a. Inefficiency of financial markets means that there exist profit opportunities that can be exploited by investors Ob. Efficient markets as a notion means that, at any point in time, volatility of assets fully reflect all available information O c. CAPM states that markets are efficient most of the time but could be efficient sometimes O d. Perfect information and investors' rationality imply that markets are inefficient O e Financial markets are always efficient because investors can always obtain information from big banks 9 Not Suppose two investors A and B have each a current portfolio M with Erm= 12% and ON-1%. Suppose that both investors are facing two portfolios I and p such that Er, -15%, Erp = 17%, 0, -2.5%, and on = 4.5%. If A chooses I and B chooses p, then we can say Choose the most accurate answer Marked out of Flag question Select one: a. Both are risk averse with the same degree O b. Both are risk averse, but A is more averse than B O c. Both are risk averse, but B is more averse than A d. A is risk averse and B is risk lover e. Both are risk lover, but A is more risk lover than B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts