Question: Question 7 Goods and Services Tax (8 marks) 1. Peter is an Uber driver and works on Friday nights when he does not hang out

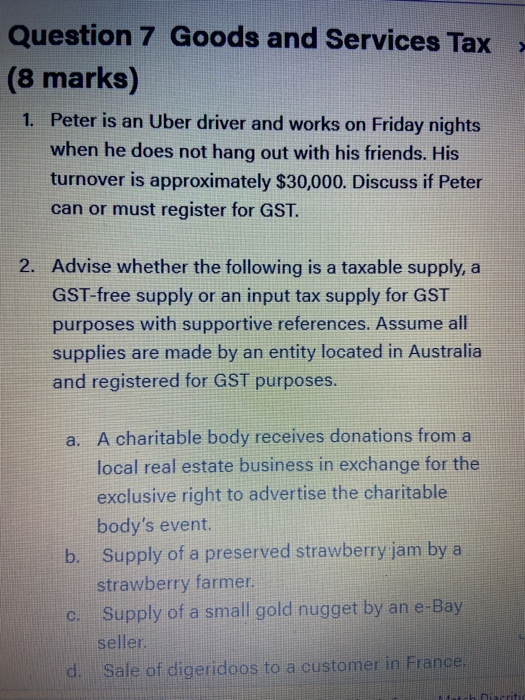

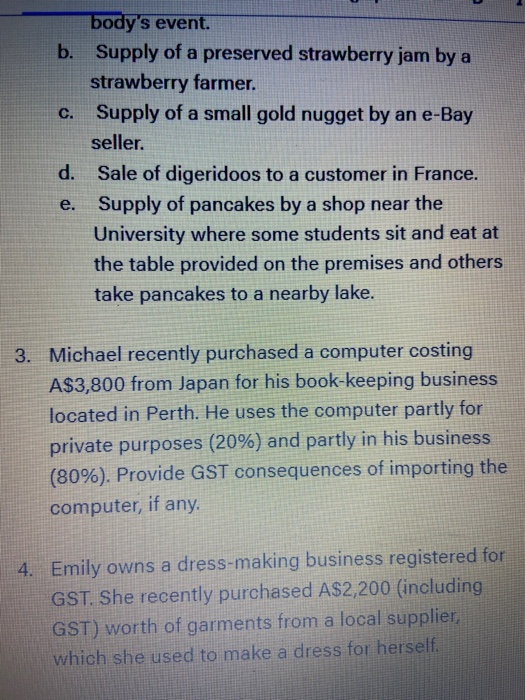

Question 7 Goods and Services Tax (8 marks) 1. Peter is an Uber driver and works on Friday nights when he does not hang out with his friends. His turnover is approximately $30,000. Discuss if Peter can or must register for GST. 2. Advise whether the following is a taxable supply, a GST-free supply or an input tax supply for GST purposes with supportive references. Assume all supplies are made by an entity located in Australia and registered for GST purposes. a. A charitable body receives donations from a local real estate business in exchange for the exclusive right to advertise the charitable body's event. b. Supply of a preserved strawberry jam by a strawberry farmer. Supply of a small gold nugget by an e-Bay seller. d. Sale of digeridoos to a customer in France, C critic body's event. b. Supply of a preserved strawberry jam by a strawberry farmer. c. Supply of a small gold nugget by an e-Bay seller. d. Sale of digeridoos to a customer in France. Supply of pancakes by a shop near the University where some students sit and eat at the table provided on the premises and others take pancakes to a nearby lake. 3. Michael recently purchased a computer costing A$3,800 from Japan for his book-keeping business located in Perth. He uses the computer partly for private purposes (20%) and partly in his business (80%). Provide GST consequences of importing the computer, if any. 4. Emily owns a dress-making business registered for GST. She recently purchased A$2,200 (including GST) worth of garments from a local supplier, which she used to make a dress for herself

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts