Question: Question 8 (1 point) If a company does not pay dividends we should use the following approach to value a stock: Corporation Valuation model focusing

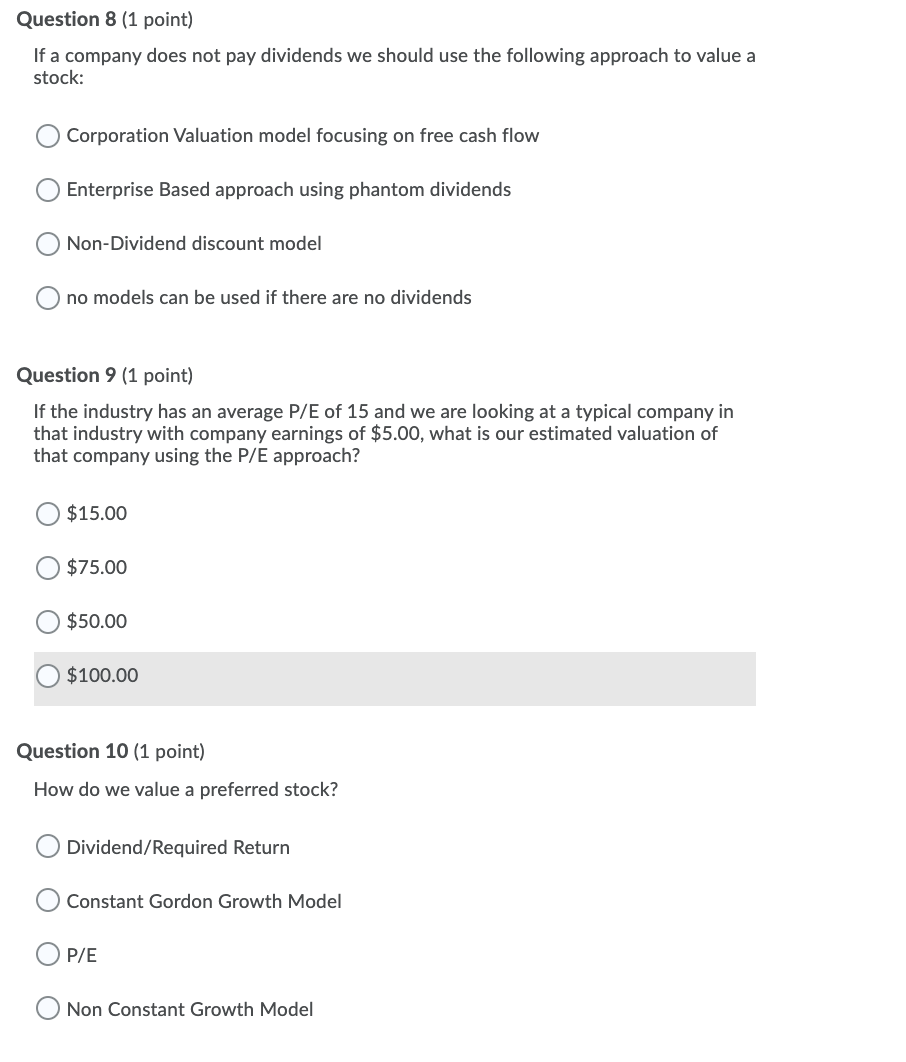

Question 8 (1 point) If a company does not pay dividends we should use the following approach to value a stock: Corporation Valuation model focusing on free cash flow Enterprise Based approach using phantom dividends Non-Dividend discount model no models can be used if there are no dividends Question 9 (1 point) If the industry has an average P/E of 15 and we are looking at a typical company in that industry with company earnings of $5.00, what is our estimated valuation of that company using the P/E approach? $15.00 $75.00 $50.00 $100.00 Question 10 (1 point) How do we value a preferred stock? Dividend/Required Return Constant Gordon Growth Model P/E d Non Constant Growth Model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts