Question: Question 9 (1 point) Compute call price using BS model using calculator. Stock price is 100, strike price is 100, volatility is 30%, option expires

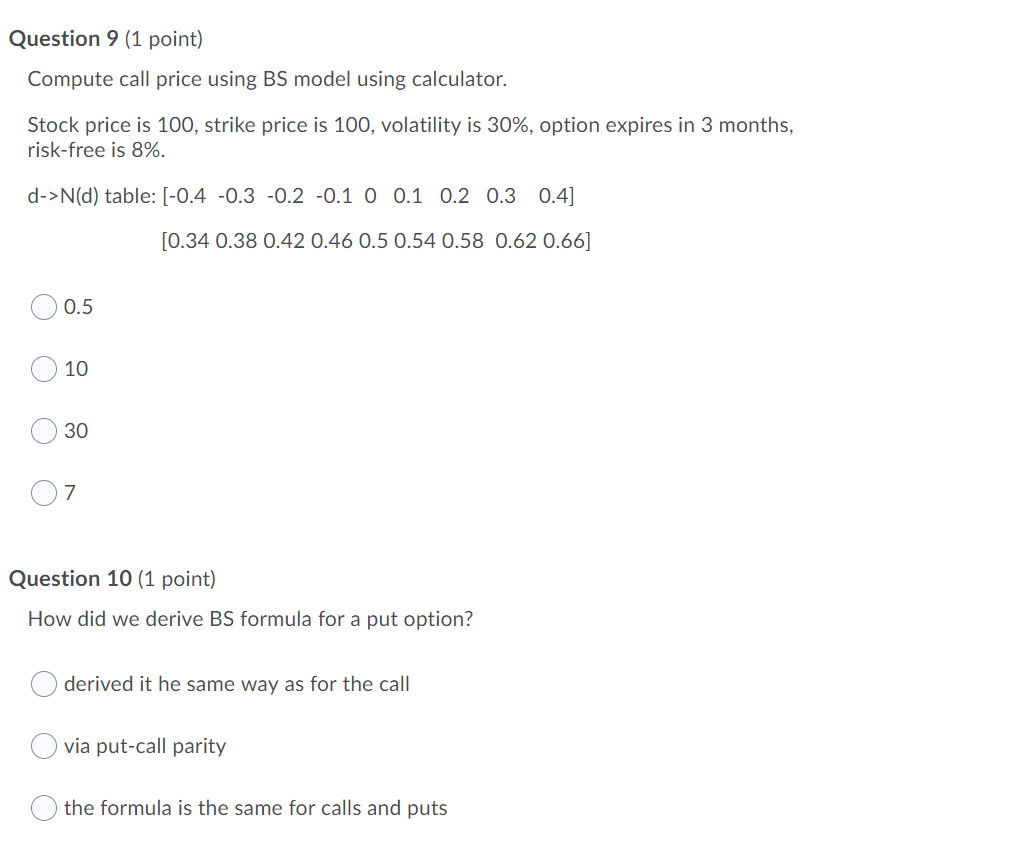

Question 9 (1 point) Compute call price using BS model using calculator. Stock price is 100, strike price is 100, volatility is 30%, option expires in 3 months, risk-free is 8%. d->N(d) table: (-0.4 -0.3 -0.2 -0.1 0 0.1 0.2 0.3 0.4] [0.34 0.38 0.42 0.46 0.5 0.54 0.58 0.62 0.66] 0 0.5 O 10 0 30 07 Question 10 (1 point) How did we derive BS formula for a put option? derived it he same way as for the call via put-call parity O the formula is the same for calls and puts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts