Question: Question 9 1 pts General Motors issues $10,000 par value 5-year maturity bonds with a 5% coupon rate, paid semi- annually (twice per year), with

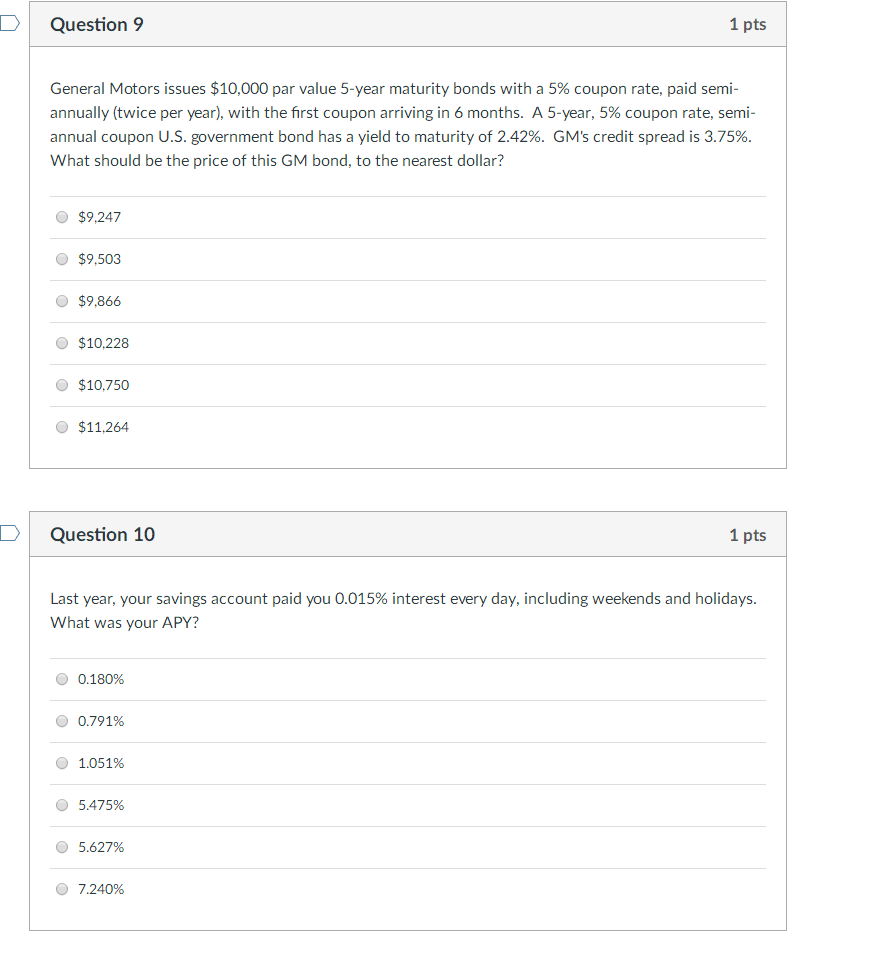

Question 9 1 pts General Motors issues $10,000 par value 5-year maturity bonds with a 5% coupon rate, paid semi- annually (twice per year), with the first coupon arriving in 6 months. A 5-year, 5% coupon rate, semi annual coupon U.S. government bond has a yield to maturity of 2.42%. GM's credit spread is 3.75% What should be the price of this GM bond, to the nearest dollar? $9.247 $9,503 $9,866 $10,228 $10,750 $11,264 Question 10 1 pts Last year, your savings account paid you 0.015% interest every day, including weekends and holidays What was your APY? O 0.180% O 0.791% 1.051% 5.475% O 5.627% 7.240%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts