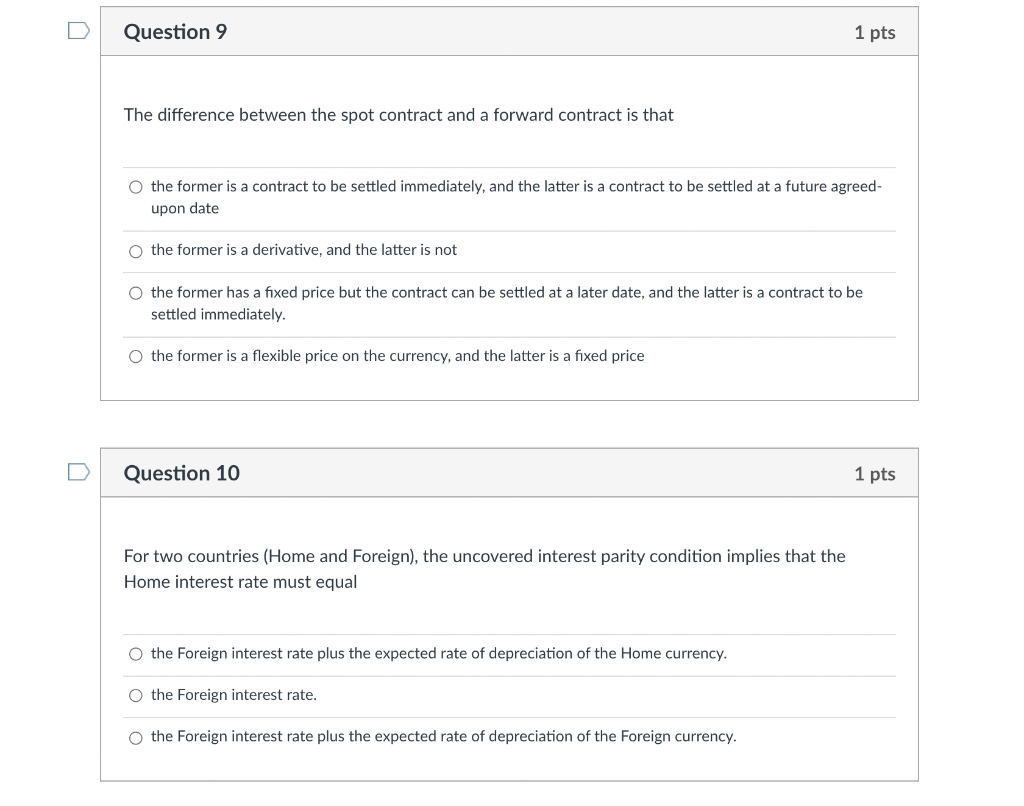

Question: Question 9 1 pts The difference between the spot contract and a forward contract is that the former is a contract to be settled immediately,

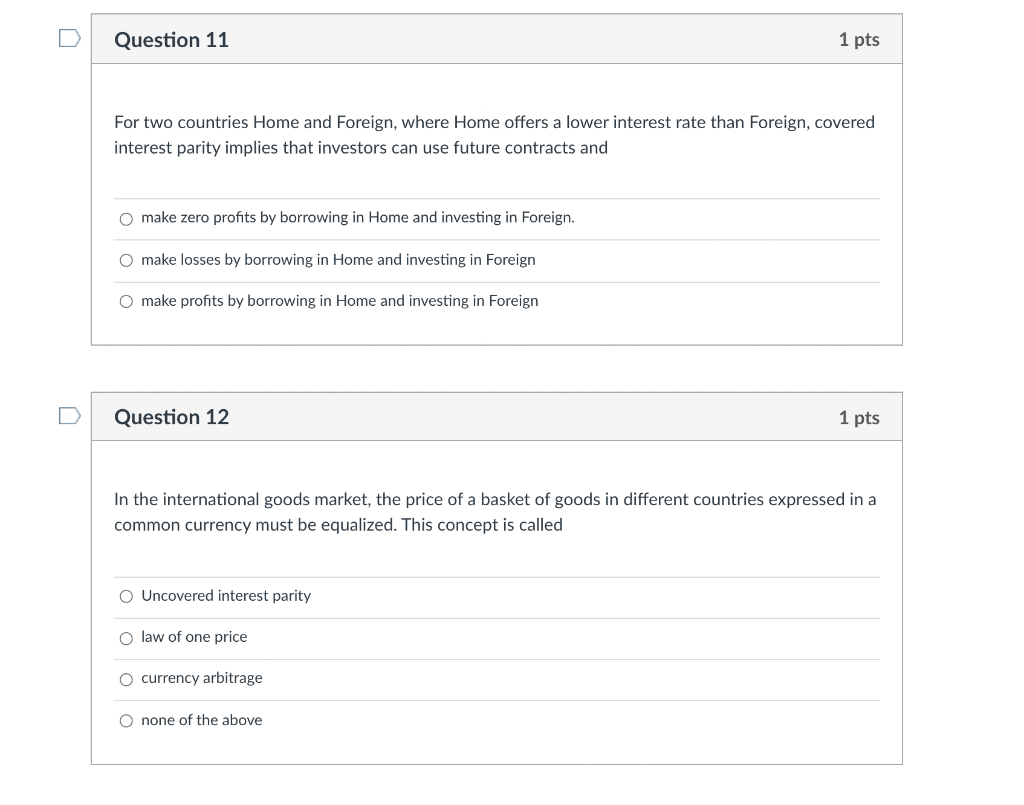

Question 9 1 pts The difference between the spot contract and a forward contract is that the former is a contract to be settled immediately, and the latter is a contract to be settled at a future agreed- upon date o the former is a derivative, and the latter is not the former has a fixed price but the contract can be settled at a later date, and the latter is a contract to be settled immediately. the former is a flexible price on the currency, and the latter is a fixed price Question 10 1 pts For two countries (Home and Foreign), the uncovered interest parity condition implies that the Home interest rate must equal the Foreign interest rate plus the expected rate of depreciation of the Home currency. O the Foreign interest rate. the Foreign interest rate plus the expected rate of depreciation of the Foreign currency. Question 11 1 pts For two countries Home and Foreign, where Home offers a lower interest rate than Foreign, covered interest parity implies that investors can use future contracts and omake zero profits by borrowing in Home and investing in Foreign. make losses by borrowing in Home and investing in Foreign O make profits by borrowing in Home and investing in Foreign n Question 12 1 pts In the international goods market, the price of a basket of goods in different countries expressed in a common currency must be equalized. This concept is called O Uncovered interest parity law of one price O currency arbitrage O none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts