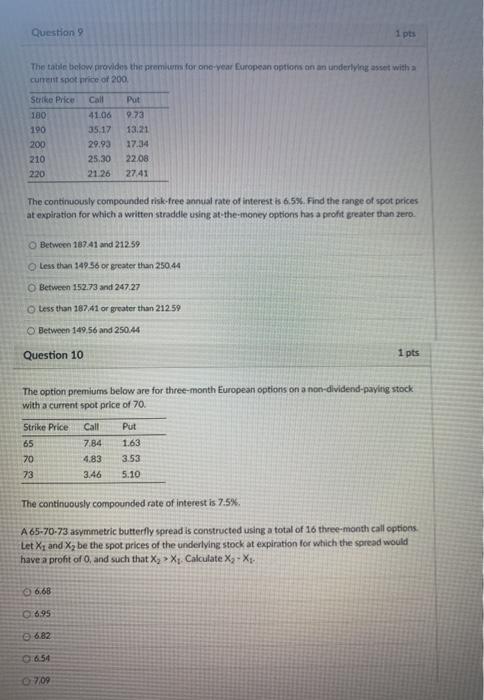

Question: Question 9 1 pts The table below provides the premium for one-year European options on an underlying asset with a current spot price of 200

Question 9 1 pts The table below provides the premium for one-year European options on an underlying asset with a current spot price of 200 Strike Price 180 190 Put 9.73 13.21 Call 41.06 35.17 29.93 25.30 21.26 200 210 220 22.08 27.41 The continuously compounded risk-free annual rate of interest is 6,5%. Find the range of spot prices at expiration for which a written straddle using at the money options has a profit greater than zero Between 187.41 and 21259 Less than 149 56 of greater than 250.44 Between 152.73 and 247.27 less than 187.41 or greater than 212.59 Between 149.56 and 250.44 Question 10 1 pts The option premiums below are for three-month European options on a non-dividend payitig stock with a current spot price of 70. Put Strike Price 65 70 73 Call 7.84 4.83 3.46 1.63 3.53 5.10 The continuously compounded rate of interest is 7.5% A65-70-73 asymmetric butterfly spread is constructed using a total of 16 three-month call options Let Xi and Xbe the spot prices of the underlying stock at expiration for which the spread would have a profit of O, and such that X3 > XCalculate X7-X, 668 6.95 682 0:654 0709 Question 9 1 pts The table below provides the premium for one-year European options on an underlying asset with a current spot price of 200 Strike Price 180 190 Put 9.73 13.21 Call 41.06 35.17 29.93 25.30 21.26 200 210 220 22.08 27.41 The continuously compounded risk-free annual rate of interest is 6,5%. Find the range of spot prices at expiration for which a written straddle using at the money options has a profit greater than zero Between 187.41 and 21259 Less than 149 56 of greater than 250.44 Between 152.73 and 247.27 less than 187.41 or greater than 212.59 Between 149.56 and 250.44 Question 10 1 pts The option premiums below are for three-month European options on a non-dividend payitig stock with a current spot price of 70. Put Strike Price 65 70 73 Call 7.84 4.83 3.46 1.63 3.53 5.10 The continuously compounded rate of interest is 7.5% A65-70-73 asymmetric butterfly spread is constructed using a total of 16 three-month call options Let Xi and Xbe the spot prices of the underlying stock at expiration for which the spread would have a profit of O, and such that X3 > XCalculate X7-X, 668 6.95 682 0:654 0709

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts