Question: QUESTION 9 10 points Save Answer Assume Johnson & Johnson just issued a dividend at an annual rate of $2.79. Its current stock price is

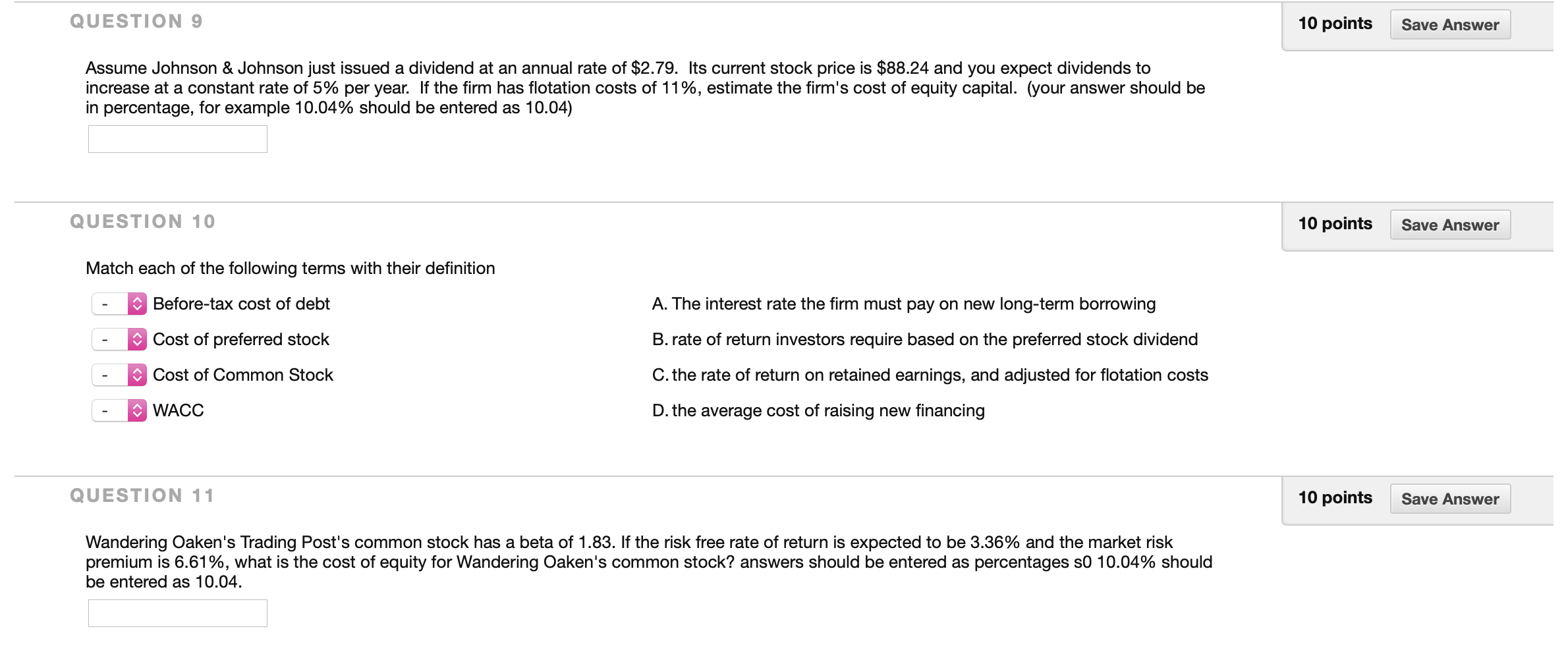

QUESTION 9 10 points Save Answer Assume Johnson & Johnson just issued a dividend at an annual rate of $2.79. Its current stock price is $88.24 and you expect dividends to increase at a constant rate of 5% per year. If the firm has flotation costs of 11%, estimate the firm's cost of equity capital. (your answer should be in percentage, for example 10.04% should be entered as 10.04) QUESTION 10 10 points Save Answer A. The interest rate the firm must pay on new long-term borrowing Match each of the following terms with their definition Before-tax cost of debt - Cost of preferred stock - Cost of Common Stock - WACC B. rate of return investors require based on the preferred stock dividend C. the rate of return on retained earnings, and adjusted for flotation costs D. the average cost of raising new financing QUESTION 11 10 points Save Answer Wandering Oaken's Trading Post's common stock has a beta of 1.83. If the risk free rate of return is expected to be 3.36% and the market risk premium is 6.61%, what is the cost of equity for Wandering Oaken's common stock? answers should be entered as percentages so 10.04% should be entered as 10.04. ndtering Trading on core quing to an entinetas

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts