Question: Question 9 & 10 Question #9: A nine-year, 6,000 par bond with an annual coupon rate of 40% paid annually sells for 6,000. Let DA

Question 9 & 10

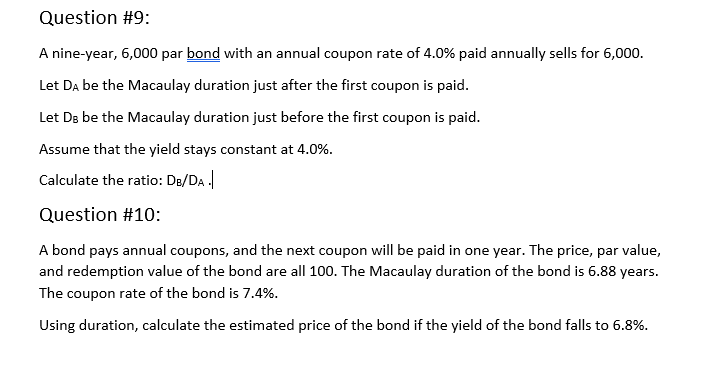

Question #9: A nine-year, 6,000 par bond with an annual coupon rate of 40% paid annually sells for 6,000. Let DA be the Macaulay duration just after the first coupon is paid. Let Ds be the Macaulay duration just before the first coupon is paid. Assume that the yield stays constant at 4.0%. Calculate the ratio: DB/DA Question #10: A bond pays annual coupons, and the next coupon will be paid in one year. The price, par value, and redemption value of the bond are all 100. The Macaulay duration of the bond is 6.88 years. The coupon rate of the bond is 7.4%. Using duration, calculate the estimated price of the bond if the yield of the bond falls to 5.8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts