Question: Question 9 (3 points) ART has come out with a new and improved product. As a result, the firm projects an ROE of 15%, and

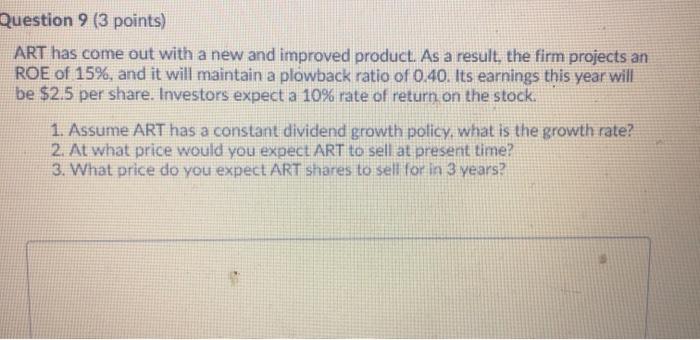

Question 9 (3 points) ART has come out with a new and improved product. As a result, the firm projects an ROE of 15%, and it will maintain a plowback ratio of 0.40. Its earnings this year will be $2.5 per share. Investors expect a 10% rate of return on the stock. 1. Assume ART has a constant dividend growth policy, what is the growth rate? 2. At what price would you expect ART to sell at present time? 3. What price do you expect ART shares to sell for in 3 years

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock