Question: Question 9 5.56 pts Answer questions 8 and 9 based upon the following information: You have decided to use June futures to hedge the risk

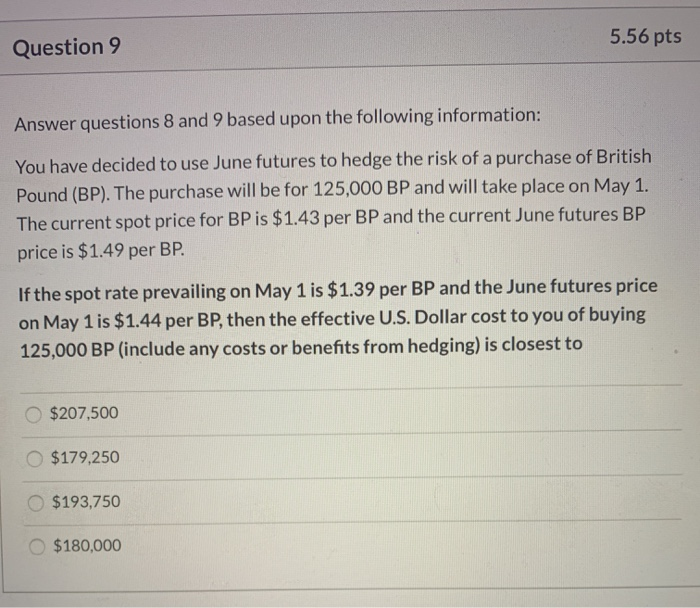

Question 9 5.56 pts Answer questions 8 and 9 based upon the following information: You have decided to use June futures to hedge the risk of a purchase of British Pound (BP). The purchase will be for 125,000 BP and will take place on May 1. The current spot price for BP is $1.43 per BP and the current June futures BP price is $1.49 per BP. If the spot rate prevailing on May 1 is $1.39 per BP and the June futures price on May 1 is $1.44 per BP, then the effective U.S. Dollar cost to you of buying 125,000 BP (include any costs or benefits from hedging) is closest to $207,500 $179,250 $193,750 $180,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts