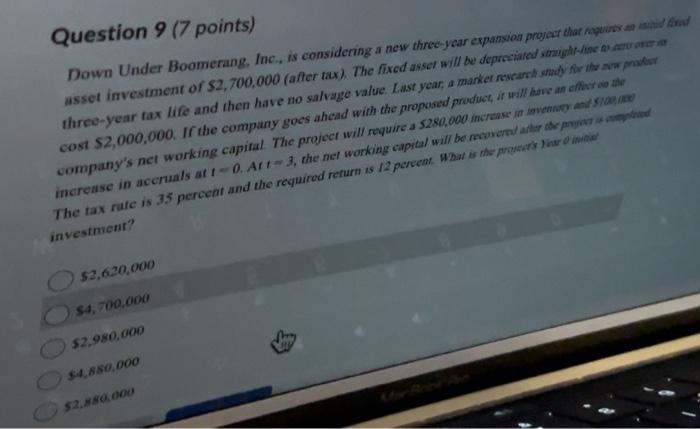

Question: Question 9 (7 points) Down Under Boomerang, Inc., is considering a new threo-ycar expansion project elat roquioran aritifinut asset investment of $2,700,000 (after tax). The

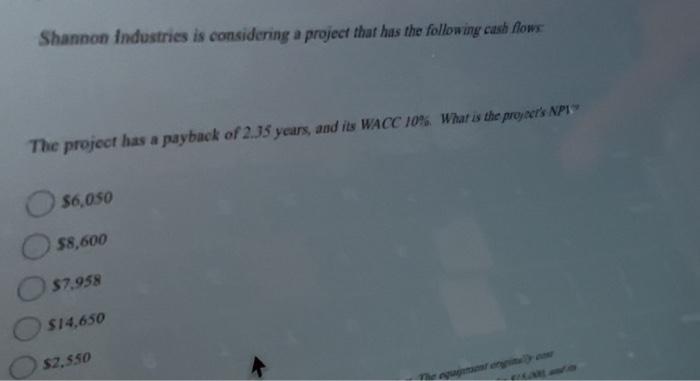

Question 9 (7 points) Down Under Boomerang, Inc., is considering a new threo-ycar expansion project elat roquioran aritifinut asset investment of $2,700,000 (after tax). The fixed asset will be depreciared smuight-lise a aavoner an three-year tax life and then have no salvage value. Last year, a market reveanct shaty for the sw prider cost 52,000,000. If the company goes ahead with the proposed product, it will havs an effort on the company's net working capiral. The project will require a 5280,000 incraase in ievemavy and spare ine The tax rate is 35 percent and the required return is 12 pereent. Whal is thref investment? 53,630,000 54. 700,000 52,980,000 94.850.000 52.480.000 Shannon industries is considering a project that has the following cash flows The project has a payback of 2.35 years, and its WACC 10%. What is the proyec's NPE? $6,050 58,600 57.958 514,650 52.550

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts