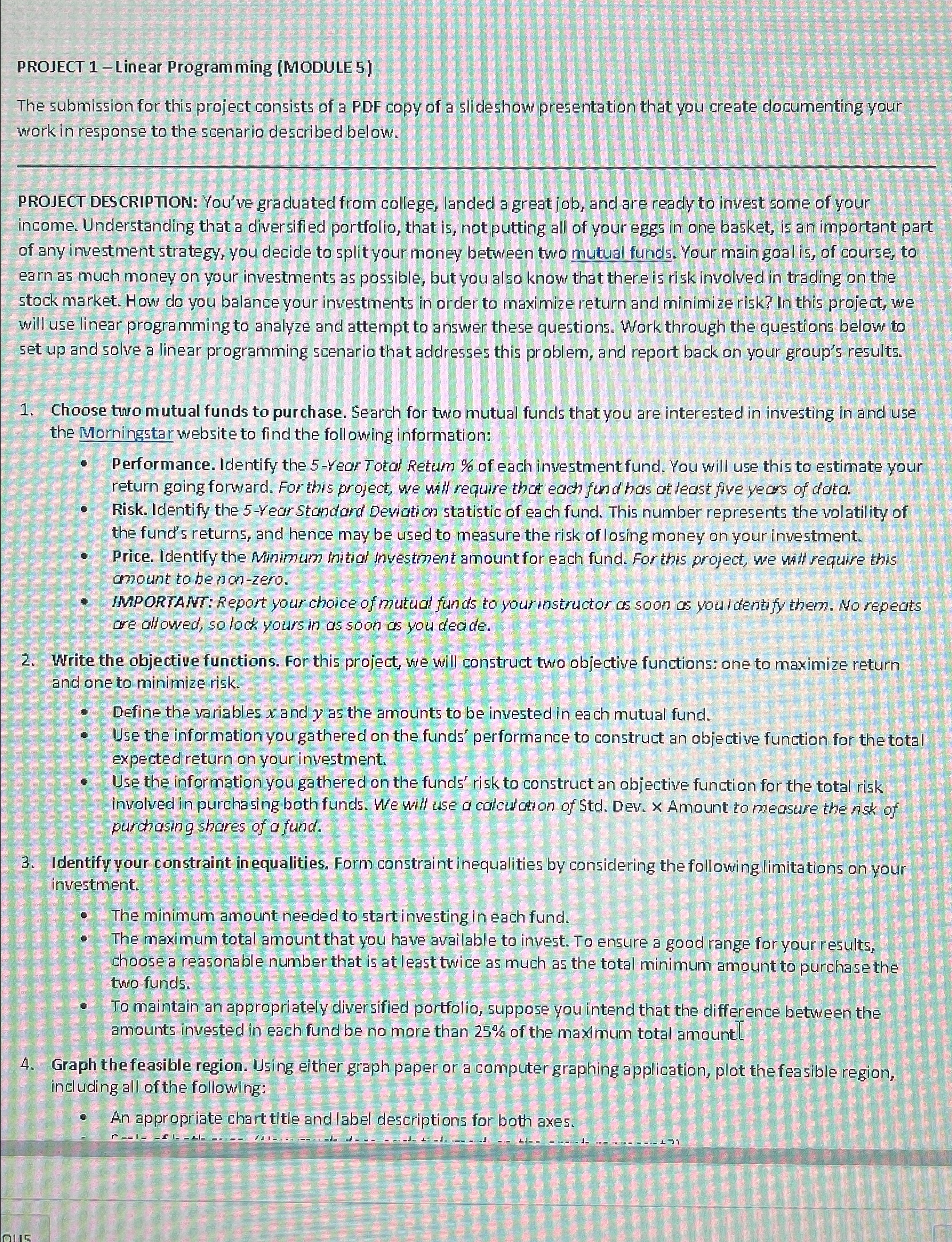

Question: PROJECT 1 - Linear Program ming ( MODULE 5 ) The submission for this project consists of a PDF copy of a slideshow presentation that

PROJECT Linear Program ming MODULE

The submission for this project consists of a PDF copy of a slideshow presentation that you create documenting your work in response to the scenario described below.

PROJECT DESCRIPTION: You've graduated from college, landed a great job, and are ready to invest some of your income. Understanding that a diver sified portfolio, that is not putting all of your eggs in one basket, is an important part of any investment strategy, you decide to split your money between two mutual funds. Your main goal is of course, to earn as much money on your investments as possible, but you al so know that there is risk involved in trading on the stock market. How do you balance your investments in order to maximize return and minimize risk? In this project, wie will use linear programming to analyze and attempt to answer these questions. Work through the questione below to set up and solve a linear programming scenario that addresses this problem, and report back on your group's results.

Choose turo mutual funds to purchase. Search for two mutual funds that you are interested in investing in and use the Morningstar website to find the following information:

Performance. Identify the Year Jotal Retum of each investment fund. You will use this to estimate your return going forward. For this project, we will require that each find has at least five years of data.

Risk. Identify the Y ear Stamdard Deviati an statistic of each fund. This number represents the wolatility of the fund's returns, and hence may be used to measure the risk of losing money on your investment.

Price. Identify the Minimum in tial investment amount for each fund. For this project, we will require this anount to benanzero.

IMPORTANT: Report your choice of mutual funds to yourinstructor as soon as you identify them. No repeats are allowed, so look yours in as soon as you deade.

Write the objective functions. For this project, we will construct two objective functions: one to maximize return and one to minimize risk.

Define the variables and as the amounts to be invested in each mutual fund.

Use the information you gathered on the funds' performance to construct an objective function for the total expected return on your investment.

Use the information you gathered on the funds' risk to construct an objective function for the total risk involyed in purchasing both funds. Wre will use a colculction of Std Dev. Amount to measure the nsk of purchasing shares of a fund.

Identify your constraint in equalities. Form constraint inequalities by considering the following limita tions on your investment.

The minimum amount needed to start investing in each fund.

The maximum total amount that you have available to invest. To ensure a good range for your results, choose a reasonable number that is at least twice as much as the total minimum amount to purchase the two funds.

To maintain an appropriately diversified portfolio, suppose you intend that the difference between the amounts invested in each fund be no more than of the maximum total amount

Graph the feasible region. Using either graph paper or a computer graphing application, plot the feasible region, including all of the following:

An appropriate chart title and label descriptions for both axes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock