Question: QUESTION 9 Consider a country with a fixed exchange rate. Assume there is initially macroeconomic equilibrium. there is no flow of assets! capital internationally i.e.

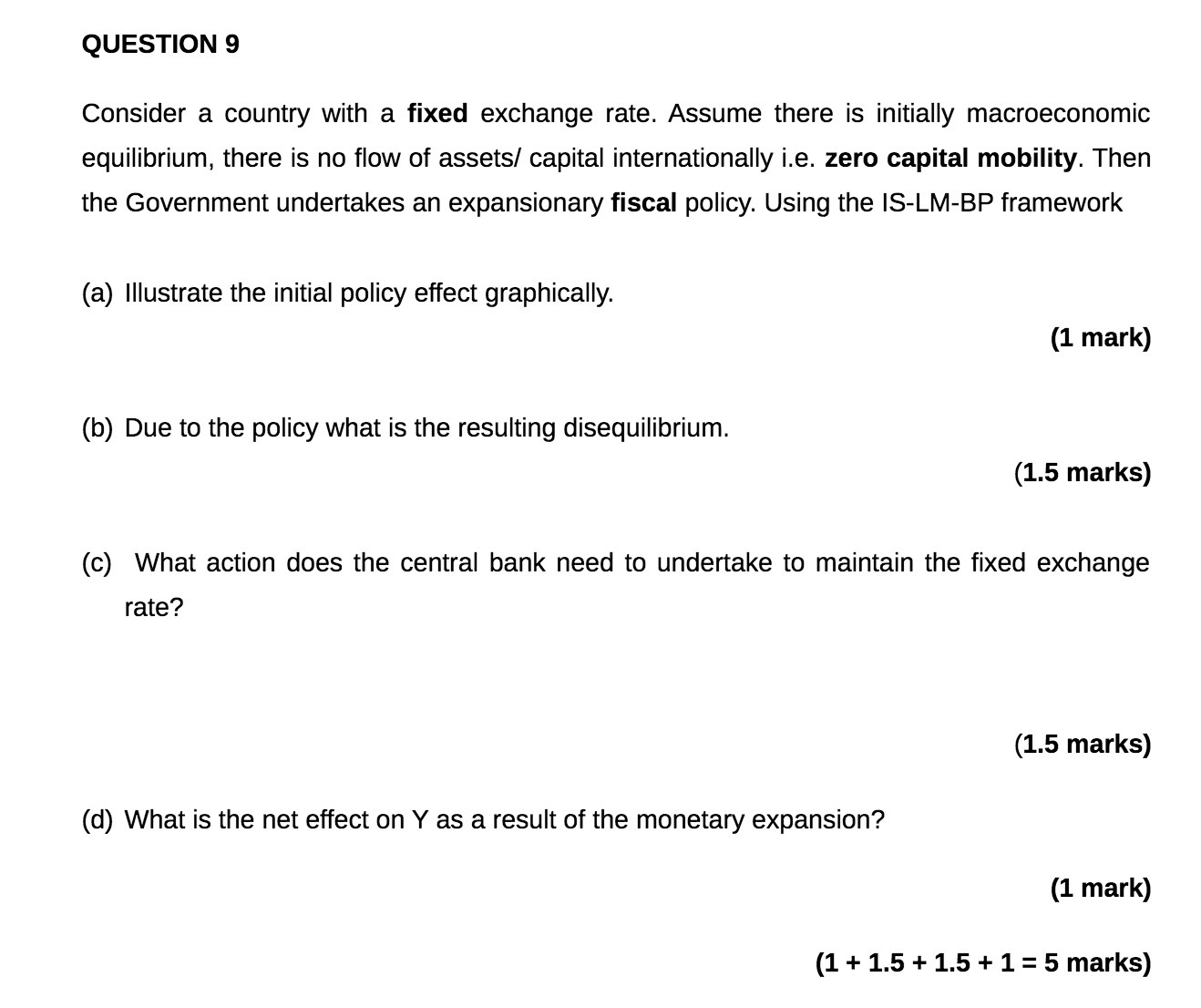

QUESTION 9 Consider a country with a fixed exchange rate. Assume there is initially macroeconomic equilibrium. there is no flow of assets! capital internationally i.e. zero capital mobility. Then the Government undertakes an expansionary fiscal policy. Using the lS-LM-BP framework (a) Illustrate the initial policy effect graphically. (1 mark) (h) Due to the policy what is the resulting disequilibrium. (1.5 marks) (c) What action does the central bank need to undertake to maintain the fixed exchange rate? (1.5 marks) (d) What is the net effect on Y as a result of the monetary expansion? (1 mark) (1 + 1.5 + 1.5 + 1 = 5 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts