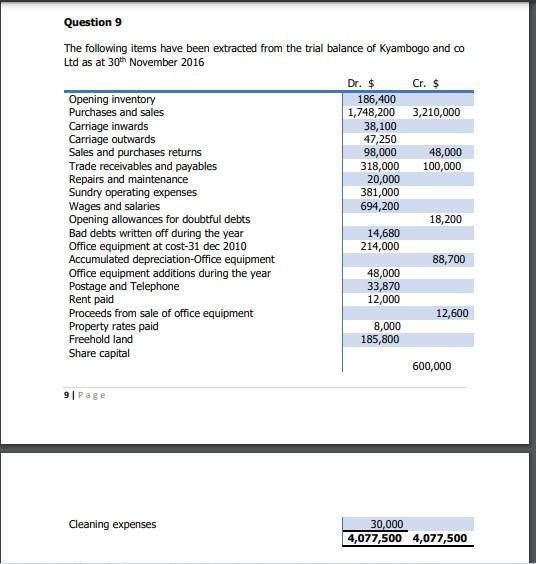

Question: Question 9 The following items have been extracted from the trial balance of Kyambogo and co Ltd as at 30th November 2016 Opening inventory

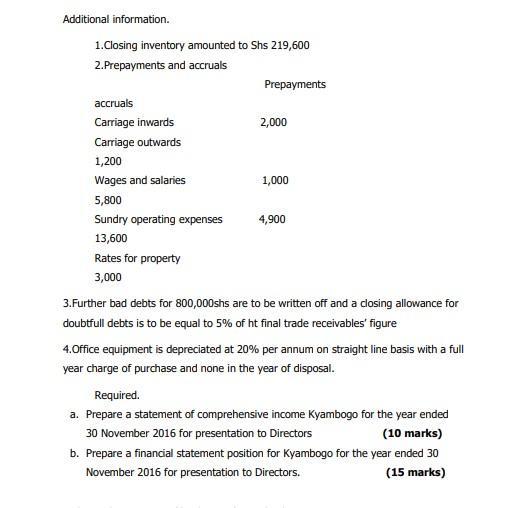

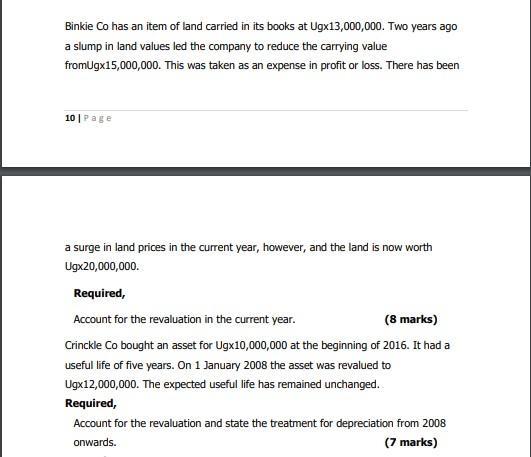

Question 9 The following items have been extracted from the trial balance of Kyambogo and co Ltd as at 30th November 2016 Opening inventory Purchases and sales Carriage inwards Carriage outwards Sales and purchases returns Trade receivables and payables Repairs and maintenance Sundry operating expenses Wages and salaries Opening allowances for doubtful debts Bad debts written off during the year Office equipment at cost-31 dec 2010 Accumulated depreciation-Office equipment Office equipment additions during the year Postage and Telephone Rent paid Proceeds from sale of office equipment Property rates paid Freehold land Share capital 9| Page Cleaning expenses Dr. $ 186,400 1,748,200 38,100 47,250 98,000 48,000 318,000 100,000 20,000 381,000 694,200 14,680 214,000 48,000 33,870 12,000 Cr. $ 3,210,000 8,000 185,800 18,200 88,700 12,600 600,000 30,000 4,077,500 4,077,500 Additional information. 1.Closing inventory amounted to Shs 219,600 2.Prepayments and accruals accruals Carriage inwards Carriage outwards 1,200 Wages and salaries 5,800 Sundry operating expenses 13,600 Rates for property 3,000 Prepayments 2,000 1,000 4,900 3.Further bad debts for 800,000shs are to be written off and a closing allowance for doubtfull debts is to be equal to 5% of ht final trade receivables' figure 4.Office equipment is depreciated at 20% per annum on straight line basis with a full year charge of purchase and none in the year of disposal. Required. a. Prepare a statement of comprehensive income Kyambogo for the year ended 30 November 2016 for presentation to Directors (10 marks) b. Prepare a financial statement position for Kyambogo for the year ended 30 November 2016 for presentation to Directors. (15 marks) Binkie Co has an item of land carried in its books at Ugx13,000,000. Two years ago a slump in land values led the company to reduce the carrying value fromUgx15,000,000. This was taken as an expense in profit or loss. There has been 10 | Page a surge in land prices in the current year, however, and the land is now worth Ugx20,000,000. Required, Account for the revaluation in the current year. (8 marks) Crinckle Co bought an asset for Ugx10,000,000 at the beginning of 2016. It had a useful life of five years. On 1 January 2008 the asset was revalued to Ugx12,000,000. The expected useful life has remained unchanged. Required, Account for the revaluation and state the treatment for depreciation from 2008 onwards. (7 marks)

Step by Step Solution

3.47 Rating (144 Votes )

There are 3 Steps involved in it

1 a Income statement for the year ended 30 November 2016 Revenue Sales and purchases 1748200 38100 3... View full answer

Get step-by-step solutions from verified subject matter experts